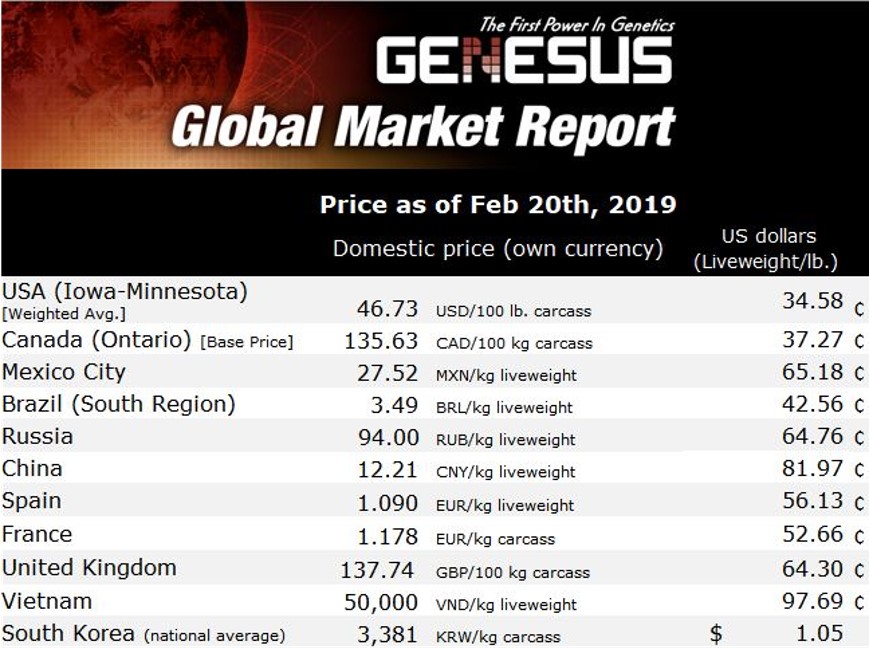

Genesus Global Market Report - SE Asia

Genesus discusses market statistics in Southeast Asia as of 20 February 2019.

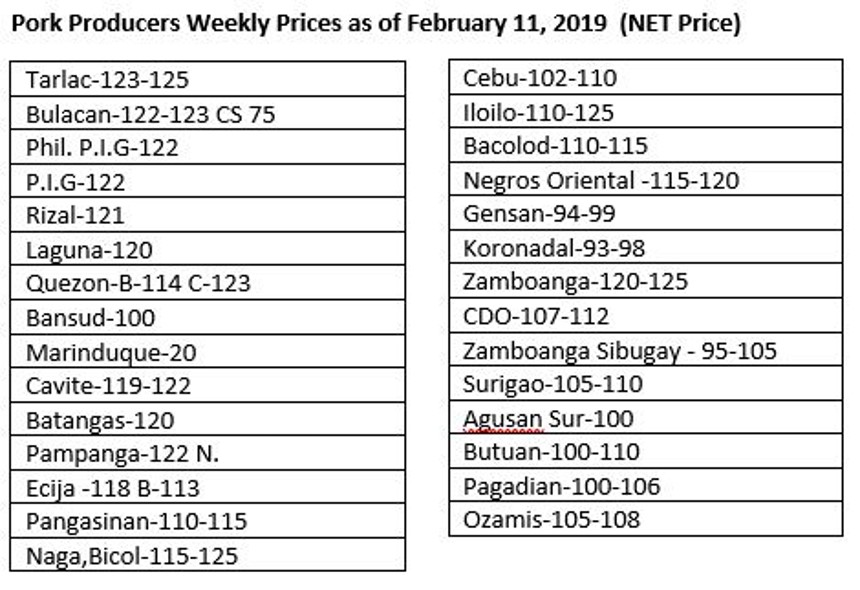

Philippines

The Philippines has banned the entry of pork and pork-based products from eight countries to prevent the spread of African swine fever in piggeries in the country, Agriculture Secretary Emmanuel Piñol announced.

Piñol said on Monday, 31 December, that the Philippines will not allow the entry of pork from Belgium, China, Hungary, Latvia, Poland, Romania, Russia and Ukraine. Confiscated pork and pork products from these countries will be destroyed within 24 hours after interception, Piñol said.

The October-December 2018 average farmgate price of hogs for slaughter was PhP 114.60 per kilogram, liveweight. This was 5.20 percent higher than the 2017 average farmgate price of PhP 108.94 per kilogram, liveweight. Within the fourth quarter of 2018, the highest average farmgate price was recorded in October at PhP 115.34 per kilogram, liveweight.

Inventory of swine in backyard farms, as of 1 January 2019, grew by 0.93 percent. This indicates a recovery from the decline of inventory at 0.33 percent in 2018. Similarly, stocks in commercial farms expanded by 0.66 percent. Central Luzon, CALABARZON, Western Visayas, Central Visayas, and Northern Mindanao were the top five regions with the highest swine population. These regions accounted for 54.71 percent of the country’s total swine population.

The volume of hog production for the fourth quarter of 2018 was estimated at 662.73 thousand metric tonnes. This was 2.01 percent higher compared with the 2017 output of 649.68 thousand metric tonnes.

The top three hog producing regions during the period were Central Luzon, CALABARZON and Northern Mindanao. These regions posted increases in production by 4.41 percent, 3.00 percent, and 3.52 percent, respectively. The combined production of these three regions accounted for 47.84 percent of the country’s total hog production.

The total pig inventory started 2018 1.5 percent up from 2017 levels. Additionally, there was a swing towards commercial enterprises, in which the pig number increased by nearly 5 percent. As such, an increase in domestic production is expected this year, with USDA forecasts pegging this at around 2 percent.

This is perhaps not surprising, since the Philippine pig industry is going through a modernisation period. Last year, the ‘Hog Industry Roadmap’ was published, a plan to address some of the major challenges facing the domestic industry over the next decade. The plan involves increasing the number of pigs sold/sow/year from 18.8 in 2015 to 30 in 2027 and doubling carcass meat production/sow/year to 3.5 tonnes.

These targets reflect a need for the Philippine pig industry to modernise if it is to keep up with growing consumer demand. The latest OECD-FAO outlook anticipates consumption grew to 15.4kg/capita last year (+3 percent year-on-year), and is now expected to reach 17.0kg/capita by 2027. The long-term growth is even larger than that anticipated when the 'Hog Industry Roadmap' was produced. To avoid losing out to increasing import levels, the domestic industry will need to become more consistent and efficient. At present, imports can be favoured in the meat processing sector, due to higher quality and presentation standards.

While commercial pig production does seem to be picking up in the Philippines, it remains to be seen whether the industry will achieve its ambitious targets over the next decade.

1 USD = 52.09 PhP.

Vietnam

The liveweight price of the pig today has moved up to 53.000 VND. This trend follows a slightly downward move in the liveweight price of the pig towards the end of 2018. During January 2019 the price began to increase and continues until now.

From 14 January, 2019 Vietnam will reduce by 66 percent the tax for all the member of CPTPP (Comprehensive Partnership and Trans-Pacific Partnership Agreement) and will reduce by 98 percent after 11 years. The animal business in Vietnam will have strong competition from other countries according to CPTPP. They estimate that the cost to produce 1 kg of live pig will be higher than other countries by 10.000 VND/kg, so if they want to export they must continue to grow the supply chain, improve the meat quality and food safety. The farmers need to improve breeding stock and performance (according to Mr Nguyen Tri Cong, Chairman of Dong Nai Association Animal Husbandry – www.baodongnai.com.vn).

The premier of Vietnam has visited some agriculture companies to encourage them to increase the export of their products.

The spread of ASF in China, has become an opportunity for Vietnam, the pig industry is enjoying high pig prices and generating good margins it is predicted that these high pig prices will continue for at least the next 12 months. It’s good to see the industry recovering and starting to invest again.

In 2018 46.8 percent of the breeding pigs imported into Vietnam were sourced from Genesus.

1 USD = 23,207.47 VND.

Thailand

Thailand’s pig price hike!!

The price of live pigs in Thailand as of February 2019 reached THB75/kg (USD 2.4/kg) or nearly doubles the price in the same period last year. Falling supplies coupled with rising consumption during the Chinese New Year in the first week of February lifted the price significantly.

The pig price hike inevitably affected pork price, which is doubled to THB 150/kg (USD 4.8/kg). This worries pig producers as rising pork price would slow down the consumption.

To avoid this, various associations of pig producers in Thailand are joining forces in reducing live pig exports to China.

1 USD = 31.33 Thai Baht.

Genesus to deliver pigs to Thailand

Genesus will deliver 34 Duroc and Yorkshire boars to its customers in Thailand including SK Inter Food in Tak province, Mongkol and Sons Farm in Chiang Mai province and SJF Farm in Ratchaburi province.

Another 50 pigs will follow suit later in March, mainly to a cooperative of pig farmers in Ratchaburi province.

Genesus’s breeding pigs are increasingly popular in Thailand. Farmers who used Genesus’ breeding pigs and semen reported that the loss due to mortality of the pigs was very low, or even close to none from birth to finish in some herds. This is a result of an improvement in disease resistant and disease resilience of the pigs, being developed by Genesus research team in Canada.

Apart from that, Genesus pigs have been proven in Thailand that they can be raised to 120kg or beyond while the carcass quality remains good.

A trial at Trang Wattana Farm in southern Thailand showed that commercial pigs (Danbred F1 sired by Genesus Duroc terminal boar) weight around 120kg had about 58 percent lean, consisting of 16kg belly, 9kg loin, 18kg shoulder and 20kg ham.

As for European genetics being used in Thailand, the pigs can be raised up to 95kg maximum. Beyond this, they tend to be very fat.