Genesus Global Market Report: South-East Asia December 2018

by Paul Anderson, General Manager South East AsiaThailand

African Swine Fever continued to be a big issue in Thailand. In November, livestock authorities spotted a sample of Chinese sausages taken from a group of Chinese tourists contaminated with ASF.

The sample in question was intercepted at a local airport in Thailand’s northern province of Chiang Rai.

The discovery prompted the authorities and pig farmers all over the country to beef up measures to control ASF. One of them is to spray all the pig lorries with disinfectants that can will kill ASF virus in a minute.

Quarantine stations all over the county are on the highest alert and increase the search to all vehicles and travellers from ASF infected areas in China.

Efficiency in the control and prevention of ASF is critical to the THAI pig industry in 2019.

If Thailand remains free from the disease, it would be an opportunity to the country to supply live pigs and pork to China, especially the infected areas that are close to Thailand such as Yunnan.

But if not, a chance for the country to recover from the price crisis early in the year will be slim.

Anyhow, the price of live pigs in the last quarter increased slightly to around THB 65/kg liveweight (USD1.9) and the average weight of market pigs was lower to around 100kg liveweight.

Main reason for the rise was a slow supply due to proliferation of PRRS.

The price will be climbing up further in January and February as demand for pork is rising during festive seasons.

Many Farmers in Thailand are now seeing the many benefits achieved by using Genesus genetics through imported semen and momentum is growing month on month, following this success many of the pig businesses are importing live GGP pigs and the next shipment is due to arrival in February 2019. We will report on the performances achieved in the trials conducted both on farm and in the meat plant in future Genesus Global Market Reports.

Vietnam

ASF in China continues with 4 new ASF cases including one first-time outbreak in Guangdong, 1 case in Sichuan, 1 case in Heilongjiang and 1 case in Chongqing. 5 reported outbreaks ASF in Yunnan, China alongside the North of Vietnam. ASF in China from beginning until 14 December, 2018 have had 89 reported outbreaks within 22 provinces and destroyed 630 thousand pigs.

The pig price in Vietnam is like a yoyo going up and down but remains at a profitable level. In the North, pig price is 42.000 – 45.000 vnd/kg (Up to USD1.93), This is lowest in Vietnam; In the Center of Vietnam is 43.000 – 49.000 vnd/kg (up to USD2.10) and in the South is 48.000 – 54.000 vnd/kg (up to USD 2.31). The cost of production is about 35.000 – 36.000 vnd/kg (approximately USD1.50 per kg of Liveweight.

In the past 3 months, the domestic pig prices tend to fluctuate sharply, especially in the time of increased and hitting 57,000 VND/kg. This is the price record high for years in some of the northern provinces. Pig in the month 8.2018 continues to maintain at a high level on the nationwide, current pig is being purchased in the North with a 52,000-55,500 VND/kg over 200% increase, compared to the low point for the year 2017 (19,000-20,000 VND/kg).

With these prices all the farmers in Vietnam are making a good profit from USD 45 – 90 per pig depending on your location, many of the pig farming businesses believe that they have recovered their loses from the 18 months of financial loses.

We are starting to see the renewed interest in updating and upgrading their breeding stock, with several enquiries for imported breeding stock and semen, 3 shipments dispatched and 2 in our Canadian quarantine things we are hoping for a prosperous 2019 which in the Chinese zodiac is the Year of the PIG !!

According to incomplete statistics of the General Department of customs, the first half of the year 2018, the country entered 19,581 tons of pork. The average count per month Vietnam enter on 3,263 tons of meat, including nearly 1,200 tons of pork from Poland, on 766 tonnes from Spain with the average import price of about 26,500vnd/kg (USD1.14)

The largest pork exporter to Vietnam is Poland and Spain; in particular, Poland is the largest import market to 7,035 tonnes, on turnover of 8 million; Spain exports to Vietnam totalled nearly 4.8 tons, 4,460 million USD.

Currently, the country has 7 FMD outbreaks in the districts of Ha Noi and Bac Ninh provinces.

Philippines

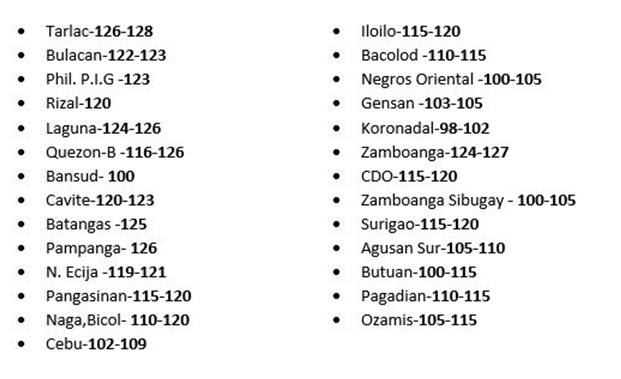

Pork Producers Weekly Prices as of December 17, 2018

(NET Price PHP: currency exchange rate = 53 PHP per 1 USD)

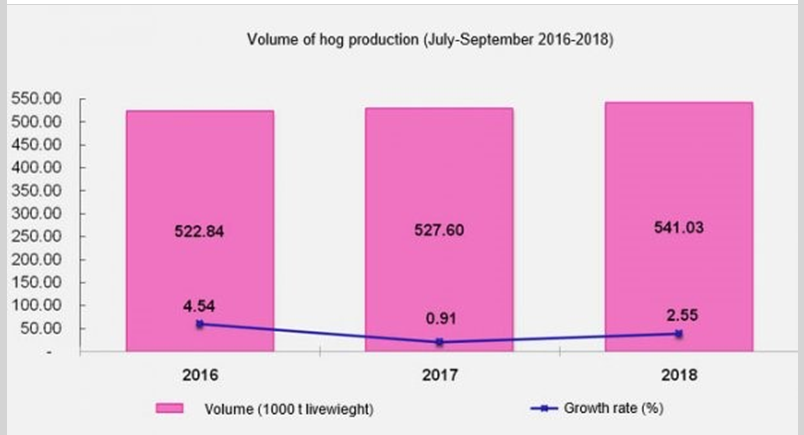

Philippine hog output up in July-Sept, Output for this quarter was 2.55 percent higher compared with the 2017 level.

For the third quarter of 2018, volume of hog production expanded to 541.03 thousand metric tons. Output for this quarter was 2.55 percent higher compared with the 2017 level of 527.60 thousand metric tons.

All regions except Mimaropa reported increases in production. Central Luzon, Calabarzon and Western Visayas were the top three producing regions, posting a positive growth of 4.87 percent, 0.55 percent, and 0.50 percent, respectively. These three regions accounted for 44.28 percent of the total hog production.