US pork exports slightly below year-ago level

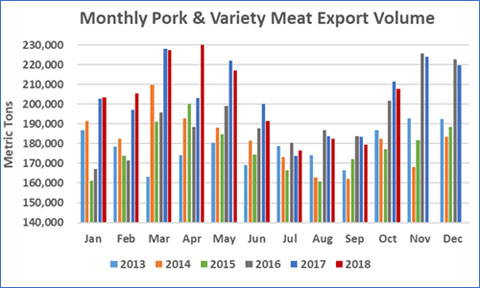

October US pork exports trended seasonally higher compared to recent months but were still below the results posted in October 2017.October pork export volume was 207,725 mt, the largest since May but still two percent lower year-over-year, reflecting smaller variety meat exports.

Export value ($536.5 million) was also the largest since May but still down five percent from a year ago. For January through October, pork exports were one percent above last year’s record pace at 2.02 million mt, while value was also up one percent to $5.33 billion.

For pork muscle cuts only, January-October exports increased five percent from a year ago in volume (1.63 million mt), valued at $4.43 billion (up two percent).

October exports accounted for 23.6 percent of total pork production, down from 25.4 percent a year ago.

For muscle cuts only, the percentage exported was 20.7 percent – down from 21.6 percent in October 2017.

For January through October, pork exports accounted for 25.8 percent of total production, down from 26.4 percent last year, but the percentage of muscle cuts exported increased from 22 to 22.5 percent.

Export value per head slaughtered was down 10 percent from a year ago in October to $46.07. The January-October average was $51.74, down two percent.

"Despite some very significant obstacles, global demand dynamics for US pork remain strong," said USMEF president and CEO an Halstrom.

"We are hopeful that the events of the past week – the signing of the US-Mexico-Canada Agreement and the return of trade negotiations between the US and China – represent progress toward elimination of retaliatory duties imposed by key trading partners.

"If we can put that situation behind us, US pork is well-positioned to regain the momentum displayed early in the year."

Mr Halstrom added that upcoming trade negotiations with Japan are critical for the US pork and beef industries, as all major competitors in the Japanese market will soon benefit from significant tariff reductions.

USMEF, along with producers, exporters and other industry organisations submitted comments to the Office of the US Trade Representative (USTR) underscoring the importance and urgency of these negotiations and will convey these points again in USTR’s 10 December public hearing.

New record for US pork in Korea, and growth in Japan and ASEAN region

Pork exports to South Korea continued to gain momentum in October, increasing 27 percent from a year ago in volume (19,588 mt) and 17 percent in value ($49.2 million).

January-October exports to Korea increased 41 percent in volume (191,610 mt) and 44 percent in value ($538.4 million) – already topping the annual records set in 2011.

Even as imports from all main suppliers have expanded this year, US share of Korea’s pork imports has increased significantly, rising from 36 to 39 percent.

October pork exports to leading value market Japan totaled 35,134 mt, up eight percent from a year ago, while export value climbed nine percent to $146.6 million. This pushed January-October exports two percent ahead of last year’s pace in volume (330,480 mt) and three percent higher in value ($1.36 billion).

This included a slight decrease in chilled pork volume (176,118 mt) while value was up two percent to $849 million. US share of Japan’s pork imports held close to 35 percent, down slightly from last year.

But Japan imported a record volume of ground seasoned pork from the European Union in October and US share in that category has dropped from 71 to 65 percent in 2018.

Unfortunately this trend is likely to continue with upcoming implementation of the Japan-EU Economic Partnership Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, which will reduce tariffs on all pork and phase the import duty on ground seasoned pork to zero over the next six years.

Led by strong growth in the Philippines and Vietnam, October pork exports to the ASEAN region increased 91 percent in volume (9,009 mt) and 59 percent in value ($22 million).

January-October exports increased 46 percent in volume (58,415 mt) and 33 percent in value ($145.5 million).

This was fueled in part by a surge in pork variety meat exports to the region, which more than doubled in both volume (24,090 mt, up 149 percent) and value ($39 million, up 126 percent).

Other January-October results for US pork exports include:

- Pork exports to South America, led by strong growth in Colombia and Peru and a rebound in exports to Chile, reached 106,444 mt – up 25 percent and already surpassing last year’s annual record. Export value was up 19 percent to $259.9 million.

- Although October results slowed from a year ago, January-October exports to Central America still increased 17 percent in volume (66,428 mt) and 13 percent in value ($156.6 million). Exports increased to leading markets Honduras and Guatemala and were sharply higher to Panama, El Salvador, Nicaragua and Costa Rica.

- Exports to the Dominican Republic have already exceeded annual records in both volume (36,022 mt, up 36 percent) and value ($78.4 million, up 29 percent).

- Exports to Australia were up 10 percent to 61,994 mt, with value climbing eight percent to $178.8 million. Australia is a critical market for US hams, especially with retaliatory duties in place in Mexico and China.

- Despite a fifth straight month in which pork shipments were below year-ago levels, exports to leading volume market Mexico were still steady with last year’s record pace at 656,284 mt. But export value, pressured by the retaliatory duties first imposed in June, declined by nine percent to $1.12 billion.

- Exports to China/Hong Kong declined 27 percent from a year ago to 302,151 mt, with value dropping 16 percent to $730 million. China/Hong Kong is the largest destination for pork variety meat exports, which were down 28 percent in volume (194,472 mt) and 15 percent in value ($512.4 million).

As reported by United States Meat Export Federation