Highest production costs since 2013 push UK producers into the red

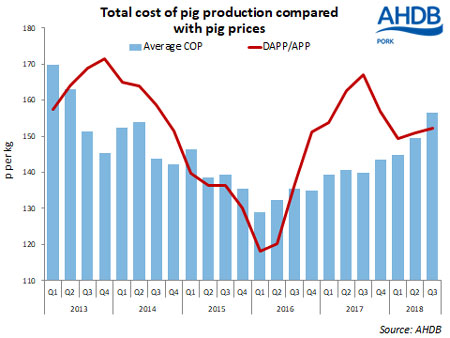

Pig production costs in the third quarter of 2018 were the highest since early 2013, according to estimates from AHDB, at 156p/kg.AHDB reports that production costs are the highest they have been since 2013.

Pig prices, in contrast, changed little in the third quarter, with the EU-spec APP averaging 152p/kg. This meant that producers were estimated to be losing, on average, around £4/pig sold during the quarter. This is the first quarter that producers have been estimated to be losing money, following 32 months of profitability.

The average GB production cost between July and September was around 7p/kg higher than the quarter before and 16p/kg up on the same time last year. Nonetheless, costs were still around 13p/kg (or £6/head) lower than the peak in 2013. With this in mind, losses are still much smaller than for most of the period between late 2010 and early 2013, as well as early 2016.

The rise in production costs compared to the previous quarter was entirely driven by rising feed costs, which accounted for 62 percent of the total cost of production. Estimated feed costs rose 7p/kg between compared to Q2, and 13p/kg compared to the same point last year.

The rise is largely driven by higher feed prices, although consumption at the finishing stage has also increased. This reflects a worsening in the average feed efficiency at this stage, according to the latest figures from Agrosoft.

The finishing Feed Conversion Ratio (FCR) was 2.79 in the 12 months to September, compared to 2.67 in the year to June. As most weight gain occurs at the finishing stage, this worsening more than offset an improvement in FCR at the rearing stage (1.79 in the year ended June vs 1.65 in the year ended September).

As has been highlighted in previous articles, physical performance can contribute significantly to protecting producer margins (click here to read more about breeding and finishing stages). Hence, lack of progress in this area can be a concern.

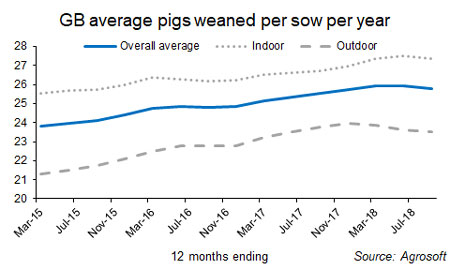

Performance at the breeding stage has also been stagnant, with pigs weaned per sow averaging 25.80 in the 12 months to September 2018, virtually on par with the 2017 average (25.75) and lower than the year ended June (25.92).

Some improvement for indoor herds was offset by a decline for outdoor sows, perhaps influenced by more challenging environmental conditions this year. Typically, productivity improves by around 0.5 pigs weaned per year.

However, the stagnation in pigs weaned per sow was offset by a reduction in finishing mortality; at 24.20, pigs sold per sow has picked up compared to both 2017 and the year ended June (both 24.09). This improvement was driven by indoor units.

Pig prices have fallen in recent weeks to around 148p/kg in the first half of November, while feed prices have probably remained fairly stable overall. Therefore, producer margins have likely worsened further. Note however that these estimated margins are derived from a full economic costs, which includes some non-cash costs such as depreciation and family labour.

While these are important for assessing the sustainability of the industry, these factors don’t affect cash flow of businesses. As such, producers can survive for some time with negative margins, provided prices remain above cash costs.

Estimates suggest that, on average, non-cash costs could account for around 15-20p/kg of the total cost of production. This would mean that cash costs have remained below GB pig prices in 2018, supporting the view put forward in the recent outlook that we wouldn’t yet expect to see a significant reduction in herd sized overall. Of course though, there will be considerable variation between producers.

During these more challenging times it is important that producers control their costs. Physical performance can be an important component of this, and the latest figures perhaps indicate there is room for development in this area if long-term improving trends are to continue.

As reported by Bethan Wilkins, Analyst for AHDB Pork