Genesus Global Market Report: Mexico

Mexico is a net importer of pig meat (pork), with a self-sufficiency rate of about 60%.by Fernando Ortiz, Ibero-Americano Business Development, Genesus Inc.

Pork balance in Mexico

The USA is the main foreign supplier (86%), followed by Canada. According to FAS, Mexico is seeking to diversify its import of red meat, for instance from Brazil. Imported pork consists of in-bone hams, carcasses and mechanically deboned meat.

Mexico remained the United States’ third largest agricultural partner in 2017. U.S. agricultural and related product exports totaled USD 19.5 billion and accounted for nearly 12.3 percent of total U.S. exports in the sector and 65 percent of Mexico’s total agricultural imports. The United States remains Mexico’s principal agricultural trading partner, receiving USD 25.5 billion, or almost 78 percent, of Mexico’s total agricultural exports. Overall U.S. market share in Mexico has remained high, as geographic advantages continue to make the United States the best supplier for most major agricultural goods. However, Mexico has been active in looking for alternate sources of supply given bilateral trade uncertainties.

Indeed, Mexico is the largest volume market for U.S. pork products and second in dollar value to Japan.

Mexico Pork Meat Market Overview

(Figures in thousands of metric tons CWE*)

*Carcass-Weight Equivalent (CWE)

p = Projected data

Source: Foreign Agricultural Service's

Production, Supply and Distribution (PSD)

The United States has historically dominated Mexican pork imports. Pork is consumed daily in a variety of dishes, including “tacos al pastor,” a traditional taco made with pork. Imported pork not only goes to retail and consumers but also to meat processors for use in processed meat products such as sausage and ham (deli-meat).

Mexican hog market

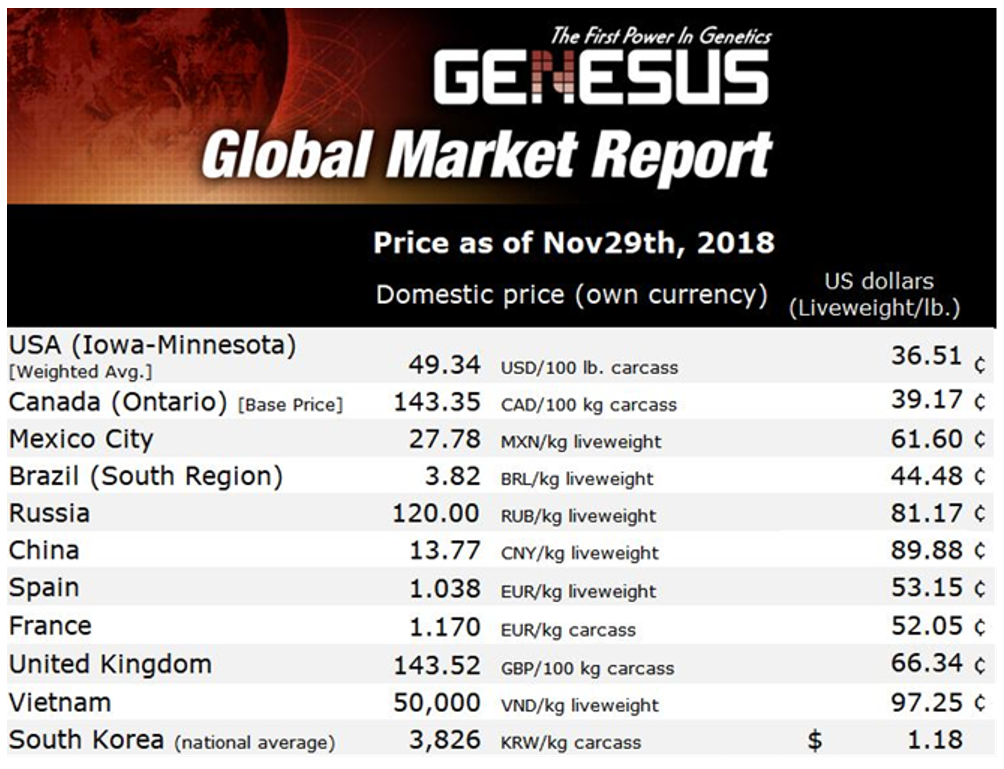

Over the last two years, 2016 – 2018 Mexican hog market has been relatively steady averaging 27 pesos/kg liveweight ($0.60/lb). Mexican pork producers have made money during this period and good proof of this is the expansion of the national herd

Average daily hog price (liveweight) 2016 – 2018 (MX$/kg)

Pork Production

Pork production in Mexico this year compared with 2017 is very similar, with a projected little increased by the last quarter 2018.

Large integrators will be better able to stay in business, while smaller units may have to get out of the business because the cost of production is rising a little bit. In Mexico, anything with 1000 or more sows is considered large. They have the grain and they own the packing plants.

The strengths of the Mexican swine industry relative to the United States include: lower labor and land costs, easier permitting, and cooperative pork producer networks. If Mexican swine producers can deal with the challenges presented by the high cost of building materials and equipment, the need to import grain, and a poor transportation, utilities, and education infrastructure, the industry can continue to thrive.

International markets

The Mexican export mainly focuses on East Asian countries: Japan as biggest, South Korea and China. Countries such as Japan and Korea demand special, tailor-made pig meat products that Mexico can deliver, and Mexico has a comparative advantage due to relatively cheap labour. Recently, Mexico has been developing its export to other countries such as Canada, Hong Kong, and Singapore.