US pork export value still under pressure

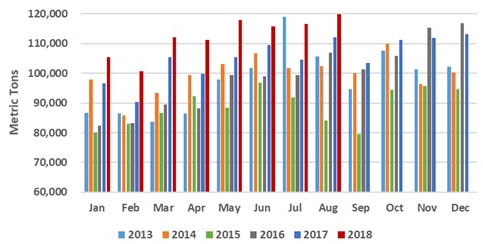

August pork exports were fairly steady with last year’s volume, but retaliatory duties in key markets continued to pressure pork export valueAugust pork export volume was down 1 percent from last year at 182,372 mt, while export value fell 3 percent to $494.1 million. Pork muscle cuts fared better in August, increasing 5 percent to 148,736 mt, but value still declined 1 percent to $414.7 million. Pork variety meat exports declined sharply in August in both volume (33,636 mt, down 20 percent) and value ($79.4 million, down 15 percent).

For January through August, combined pork and pork variety meat exports remained 1 percent ahead of last year’s record pace at 1.63 million mt, while value increased 3 percent to $4.32 billion. For pork muscle cuts only, exports increased 6 percent from a year ago in volume (1.31 million mt) and 4 percent in value ($3.58 billion).

August exports accounted for 21.9 percent of total pork production, down from 23.1 percent a year ago, while the percentage of muscle cuts exported held steady at 19.2 percent. For January through August, exports equaled 26.3 percent of total pork production (down from 26.9 percent a year ago), while the percentage of muscle cuts exported was 22.8 percent (up from 22.4 percent). Pork export value averaged $44.29 per head slaughtered in August, down 8 percent from a year ago, while the January-August per-head average dropped 1 percent to $53.28.

US pork currently faces retaliatory duties in two markets: China and Mexico. China’s duty rate on pork muscle cuts and variety meat increased from 12 to 37 percent in April and from 37 to 62 percent in July. Mexico’s duty rate on pork muscle cuts increased from zero to 10 percent in June and jumped to 20 percent in July (pork variety meats continue to enter Mexico duty-free). Beginning in June, Mexico also imposed a 15 percent duty on sausages and a 20 percent duty on some prepared or preserved hams and shoulders.

"Pork exports have posted an impressive performance in 2018, but the retaliatory duties are a clearly a significant obstacle," USMEF President and CEO Dan Halstrom explained. "The fact that US trade officials were able to secure duty-free access for US red meat in the new US-Mexico-Canada Agreement is critically important, and we are hopeful that duty-free access for US pork entering Mexico will be restored soon. Tariff relief in China may not come as quickly, but USMEF continues to work with industry partners to keep as much product as possible moving to China while also working aggressively to expand exports in other key markets, including Korea, Central and South America, the ASEAN region and Australia."

Japan, Korea and Latin America bolster August pork exports

August pork exports to leading value market Japan increased 10 percent from a year ago to 34,935 mt, valued at $146.8 million (up 5 percent and the highest of 2018). For January through August, exports were up 2 percent from a year ago in both volume (265,250 mt) and value ($1.1 billion).

Pork exports to Korea continued to surge in August, increasing 39 percent in volume to 11,303 mt and 40 percent in value to $31.3 million. This pushed January-August exports to 159,536 mt (up 43 percent) valued at $455.6 million (up 49 percent). Exports of pork variety meat, including bungs and feet, have contributed significantly to this growth. Through August, pork variety meat exports to Korea increased 84 percent from a year ago in volume (10,358 mt) and more than doubled in value to $32.4 million (up 111 percent). Most US pork products enter Korea duty-free, and this will continue under the revised KORUS agreement.

August pork exports to leading volume market Mexico fell 4 percent from a year ago to 62,319 mt, while value dropped 21 percent to $103 million. Through August, exports to Mexico remained 2 percent ahead of last year’s record pace at 532,034 mt, but value declined 6 percent to $921.1 million.

August exports to the China/Hong Kong region fell 43 percent from a year ago to 19,732 mt, with value dropping 32 percent to $52.9 million. For January through August, exports were down 24 percent in volume (257,939 mt) and fell 13 percent in value to $615.9 million.

January-August highlights for US pork exports include:

- Led by strong growth in Colombia and Peru, exports to South America increased 29 percent from a year ago in volume (82,153 mt) and 24 percent in value ($204.4 million). A slow start to the year kept exports to Chile below last year’s record volume pace, but shipments regained momentum in July and August.

- Following a record performance in 2017, pork exports to Central America surged 20 percent higher in volume (52,528 mt) and increased 17 percent in value ($123.8 million). Pork exports to all seven Central American nations have achieved double-digit growth in 2018.

- Exports to the Dominican Republic continue to gain momentum, increasing 30 percent in volume (29,480 mt) and 25 percent in value ($64.5 million).

- Led by strong growth in the Philippines and Vietnam, exports to the ASEAN region increased 29 percent in volume (39,021 mt) and 28 percent in value ($100.1 million). The ASEAN is an especially important destination for pork variety meat, with these exports nearly doubling from a year ago in both volume (14,273 mt, up 99 percent) and value ($24.2 million, up 94 percent).

- Exports to Australia were 9 percent ahead of last year’s record pace in both volume (51,070 mt) and value ($147.5 million). Australia is the third-largest destination for U.S. hams exported for further processing, trailing only Mexico and China/Hong Kong.