EU pig prices: quotations are going down

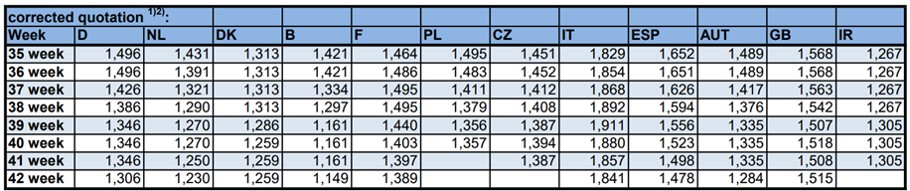

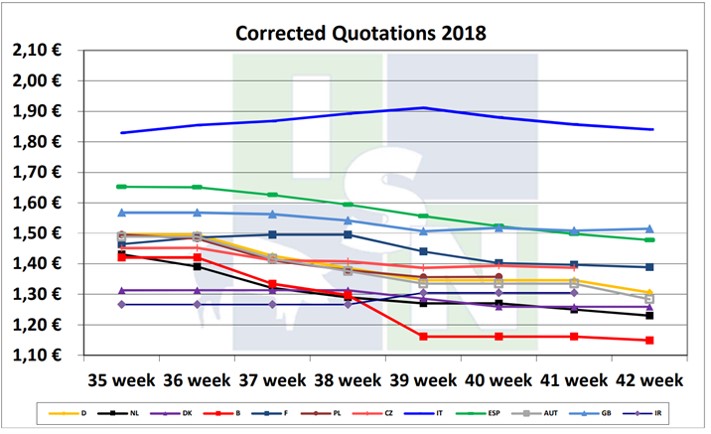

At present, the mood is gloomy in the European pigs-mature-for-slaughter market. A majority of quotations continue to go down, with the price decreases ranging from a corrected 0.8 to 5 centsAs noted by other EU member countries, the German leading quotation has gone down because of massive price pressure being exerted by German slaughter companies. Numerous companies from the German processing industry had established discounted prices, forcing the corrected prices considerably downward. All in all, the German quotation has swung back by 4 cents down to the discounted prices’ level.

On top of this, market participants continue to worry about the risk of further outbreaks of African swine fever (ASF). For seasonal reasons, the quantities of pork on offer are large altogether but it may be that the European slaughter companies are not interested in storing pork as long as there is still a major risk of ASF outbreaks. Furthermore, Belgian pork at favourable prices is entering the European markets, because third countries’ markets continue to remain inaccessible for Belgian exporters’ sales.

Due to the current market situation, as dictated by Germany, the pigs-for-slaughter quotations are also going down in Austria (- 5 cents), Spain (- 2 cents), the Netherlands (- 2 cents) and in France (- 1 cent). The Belgian quotation was also corrected downward by yet another cent.

The Danish quotation remains on a steady price level of a corrected 1.26 € per dt. Thus, the gap has increased. In the Netherlands, the quotation went down by another 2 cents, but despite this, continue to rank in the European price structure of the five EU member countries most important in pig keeping. The British quotation was able to go up a little because of currency fluctuations.

(Source: ISN - Interessengemeinschaft der Schweinehalter Deutschlands)

1) corrected quotation: The official Quotations of the different countries are corrected, so that each quotation has the same base (conditions).

2) These quotations are based on the correction formulas applied since 01.08.2010.

base: 57 % lean-meat-percentage; farm-gate-price; 79 % killing-out-percentage, without value-added-tax

Trend for the German market

At the beginning of the week, the situation proves to be well balanced on the domestic market. The marketers are expecting the quantities of live animals on offer to decrease over the course of the week. At the same time, European pork remains a very much demanded merchandise. So, from today’s point of view, the market situation may be expected to steady.

Click here for more reports on the European pigs mature for slaughter market