Manitoba Pork's cost of production model for swine producers

Manitoba Pork has worked with MNP, an accounting and consulting company, to develop different model farms to generate cash flow projections and trial balance sheets and provide some insight into the economics of the industryAs of 17 August, MNP notes that recent changes in feed and hog pricing for 2018 has put producers back into a very tight margin situation projected to the end of the year. This shouldn’t be unfamiliar territory, as it’s where we have been three of the last five years. Although we might see some relief in feed costs, the hope of $2.50/bu corn to fix our profitability is probably not on the horizon.

The models produced by Manitoba Pork are an informed estimate of the cost of production for different systems. Every producer will have different numbers for their particular situation. Manitoba Pork encourages producers to create their own comparative numbers and obtain professional advice on how best to interpret the results.

The models are as follows:

- Farrow-finish (600 sows;

- Sow-Isowean (1500 sows); and

- Finisher (6000 finisher places).

Farrow-Finish (600 sows)

Feed cost is often the first number we circle, as it makes up such a large portion of farrow to finish and grower/finisher costs, but it is sometimes the effect, not the cause. Small changes in sow productivity and barn flow efficiency can have a major impact on profit margins and feed usage. Also, of utmost importance is hitting the core of the grid on as many pigs as possible, to maximise the end dollar value.

Most Manitoba hog barns were built for lower productivity and shipping weights. Average carcass weights have increased 7 kg since 2010. Keep this in mind when considering what the best flow is for your operation. Pigs weaned per sow is a good metric, but if it means crowding in your finishing barn, it may be costing you efficiency and ultimately dollars in the end. The solution may be less sows or looking for ways to expand your finishing barn.

Sow-Isowean (1500 sows)

Isowean profitability models are based on the US Cash Market adjusted for freight. This price on an annual basis has been relatively consistent over the last four years. Individual producer contracts may be based off of a different formula price. Sow health and productivity, probably more than cost control, will be the driver of profitability for these types of operations.

Finisher (6000 finisher places)

Finisher barn cost of production continues to be the most challenged from a profitability model. The model is based off of US cash prices, whereas producers may be able to secure more favourable pricing terms on long term supply contracts. For all in all out-finisher operations, feed efficiency and shipping performance will be two of the most significant drivers of profitability, like the farrow to finish operation.

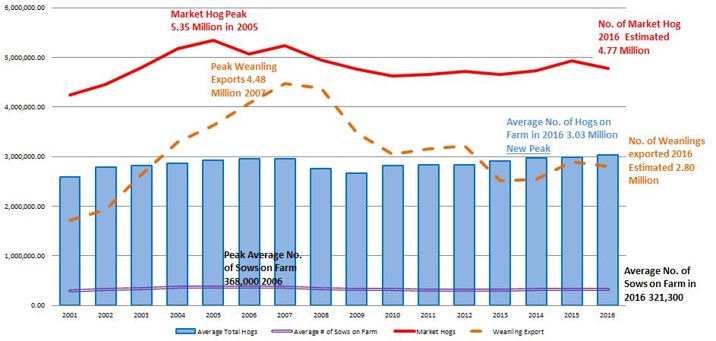

Hog production in Manitoba

Manitoba farmers have been raising pigs since the province was first settled. Early statistics show that Manitoba farmers had 17,000 pigs on farm in 1881. Since then that number has grown dramatically to almost three million on farm on July 2016. The sow herd in 2016 is estimated at 319,000 head producing over 8.0 million pigs of which 4.5 million were raised to market weight, and the rest were shipped as weanlings to finishing barns in the United States. Manitoba is the largest pig producing province in Canada, accounting for almost 30% of national production and is the largest exporter of weanlings to the US.

The changes in swine production in Manitoba over 15 years will help to produce models that can match the pattern of demand

While the number of pig farmers has declined over the years from 14,200 in 1972 to 550 farmers in 2015, the level of production has increased as farms became larger and more productive. There are now about 220 commercial farm operations on over 600 sites. The industry has moved to the three-site model with specialised large sow barns producing young pigs which are weaned at about three weeks of age and placed in nursery barns for six weeks, before being moved to finisher barns to be raised to full market weight in 14-16 weeks.

As in all parts of agriculture, the pig industry has consolidated dramatically in the past ten years. Two companies now account for over half of total production, while Hutterite Brethren produce 30%. The balance of production is by independent producers who often collaborate commercially to buy inputs and manage their operations. Hog producers use almost 2 million tonnes of feed ingredients each year, spend over $980 million on operating and capital costs, and create an additional 4500 jobs directly/indirectly in the supply and services sector. Feed costs were almost 60% of all input costs in 2015.

Read the full report here