Market not looking very shiny?

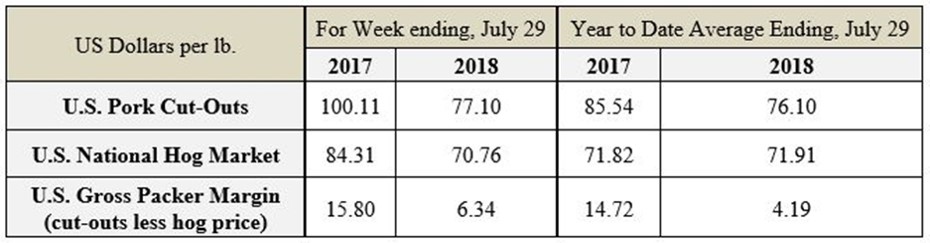

Jim Long commentary: A year ago, US 53-54 percent lean hogs were 86¢ lb but last week they were near 66¢ lb. That’s $40 per head less. A huge difference. Pushing close to $100 million less per week for the US industryThe estimated average value of US pork cut-outs is not doing any better. The last week of July 2018, they averaged 77.10¢ lb. a year ago 100.11 – more than $40 a head difference.

You don’t need a computer to see both packers and producers are getting less money right now.

The market, in our opinion, has taken a $20 per head discount from where it should be currently, due to the tariffs that have been put on US pork by Mexico and China. We expect pork is still moving to both countries but at a price lowered by the tariffs. Mexico is the major buyer for US hams: a year ago US hams were 75.24¢ lb but are now 53¢ lb – 29% lower.

Farmer Arithmetic – Hams 25% of a carcass – 200 lb carcass = 50 lb of Ham x 20¢ lb lower price than a year ago = $10 per head lower.

Of note, Mexico hog price is 80¢ US lb live weight or about $60 US per head higher than US. Winners in the tariff war are Mexican hog producers.

When we look at lean hog futures we believe they have become discounted by about $20 per head due to tariffs from Mexico and China.

The US administration has promised $12 billion in aid to agriculture in support due to tariffs put on their products. Swine producers are to get some of this but no details have been released.

Most US producers hope for a trade resolution so unimpeded commerce can be restored.

Canadian producers are part of the collateral damage of the pork tariffs. Canada’s hog prices track the US prices – as the US price goes down, so does Canada’s. Although Canada can still send pork duty free to both China and Mexico, Canadian hog prices have declined. The Canadian government has offered no aid to Canadian swine producers. US pork producers have much more government support than Canada’s producers.

Other Observations:

China’s hog price has moved up 30% since May. The price is now reaching 90¢ lb. US live weight – back in profit range.

Appears that Seaboard – Triumph plant in Sioux City will start second shift this fall. This is good news for producers as it will add packer shackle capacity. Second shift at capacity minimum 8,000 head per day.

The first case of African Swine Fever (ASF) in China has been reported in North-East China. About 1,000 pigs were destroyed and a large quarantine area was put in place. If ASF got rolling in China, it would be a huge market mover.

In the magazine Pig Progress Thomas Henriksen, the CEO of Danbred was interviewed. We found the following quote interesting.

“Pig farms are growing and that’s what we are supposed to do as well. Competitors, like PIC, Topigs Norsvin or Genesus, have a comparable organisational structure to the one we are currently developing. I project that, just like in the poultry business, in the future only a handful of breeding organisations will remain active in the swine business. To be among them means that we don’t have any other choice than to reorganise. Otherwise we will not stay in business.”

We agree with Mr Henriksen’s recognition there are now four global swine genetic companies. PIC, Danbred, Topigs-Norsvin and Genesus. A global battle is engaged. Genesus will remain focused on continued genetic improvement and growing one customer at a time.