China Market Report

Genesus provides a market update for the China hog marketAs reported by Lyle Jones, Director of Sales, Genesus China

Observations:

It is very good to be back working now in China with Genesus Genetics. I made my first trip to China back in July 2010 and have had the opportunity to visit over 50 times since. With half of all the pigs in world here, there is no doubt this is the place to be. However, during a recent 23 day trip we have heard that one of the well-known European Genetic companies is pulling out of China.

China is no doubt a very challenging market, but the people are quite friendly and there is much opportunity. It is amazing how fast the migration of the people from the rural areas to the large cities like Beijing. With that movement the people are becoming better educated, find better jobs and becoming increasingly wealthy.

With this rapid increase in wealth comes unique opportunities as the people are looking for healthier foods and healthy lifestyles. Thus the Chinese consumption of pork is increasing and the consumer awareness of Pork Quality is on the rise. Congratulations to our Chinese friends and customers!

A growing number of integrators are now recognising that the future of Pork Production in China will be driven by Pork Quality. Genesus has made Carcass and meat quality traits a centrepiece of its genetic selection criteria and research and development programme for 20 years now. It’s interesting to learn that another leading genetic company recently announced that it is just now starting to pay attention to the consumers' eating satisfaction. Hmm… This tells me that Genesus is not only on the right track, but in the driver’s seat when it comes to meat quality.

On another note, the recent talk about trade tariffs seems to be having an effect upon the market in China as we saw the price of pork rise from 11.2 to 12.8 RMB per kg while we were in country. Costs of production are expected to rise by at least 3% as a result of increased costs of soybeans. We expect the Chinese government to continue to heavily support the construction of new farms and large pork production systems through its favourable subsidy programmes.

Market Conditions:

The Ministry of Agriculture and Rural Affairs reported the prohibited zone for pig production has been set up resulting in reduction of 34 million pigs. The pig inventory in the first quarter is 415.23 million, declined by 1.2% against last year.

Production Information:

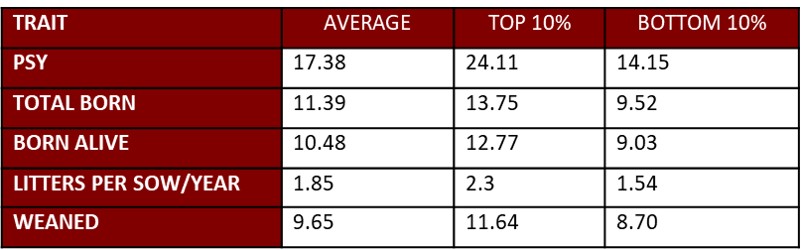

China hog production efficiency has been improved significantly since my first visit to China in 2010. The MSY (marketed hogs per sow per year) has increased from 13.2 in 2009 to 19.34 in 2017. While production efficiency is improving, there still is too much lost opportunity. The Chinese are embracing better genetics and more efficient management practices to improve production and recognise that meat quality will be the future. These factors will guide their government policies going forward.