Genesus Global Market Report: France

This is our first Global Market Report focusing on France, therefore a short introduction to the French pig production.by Philippe Mallétroit, Director France, Genesus Inc.

France today has 960,000 sows – down from 1,250,000 sows back in 2000 - producing 21.3 million finisher pigs annually. The French pig industry is dominated by smaller family farms. Farrow-to-finish farms represent 82% of all sows, with an average of 200 sows per farm.

73% of the pigs are produced in North West of France, Brittany area.

French farmers are known for being good producers, with high productivity per sow. Throughout farms in France you see group housing systems, anything from pens to ESF to Gestal 3G system. As many European countries, France has been dominated by lean production (pietrain), but starting to see a turn towards Duroc. Average slaughter weight in France is 115-120 kg. Cooperatives are an important part of the French pig industry – the two largest Coop’s being Cooperl and Aveltis, together they operate around 350,000 sows Organic farming start to grow slowly in France, with a target of about 1 million organic finisher pigs produced on the upcoming years.

French export of pork declined by 5% in 2017, this mostly due to the constant decrease in sow numbers. In 2016 China was the main export market for French pork – despite the decline they saw in 2017, China remained a significant export market for France, accounting for 11.5% of the market share in 2017. The decline of export to China was offset by an increase to other markets – exports to Italy increased by 28% and brought Italy back as the main market for French pork in 2017.

Pork imports increased by 3% in 2017 – all coming from other EU countries, with Spain being the main importer

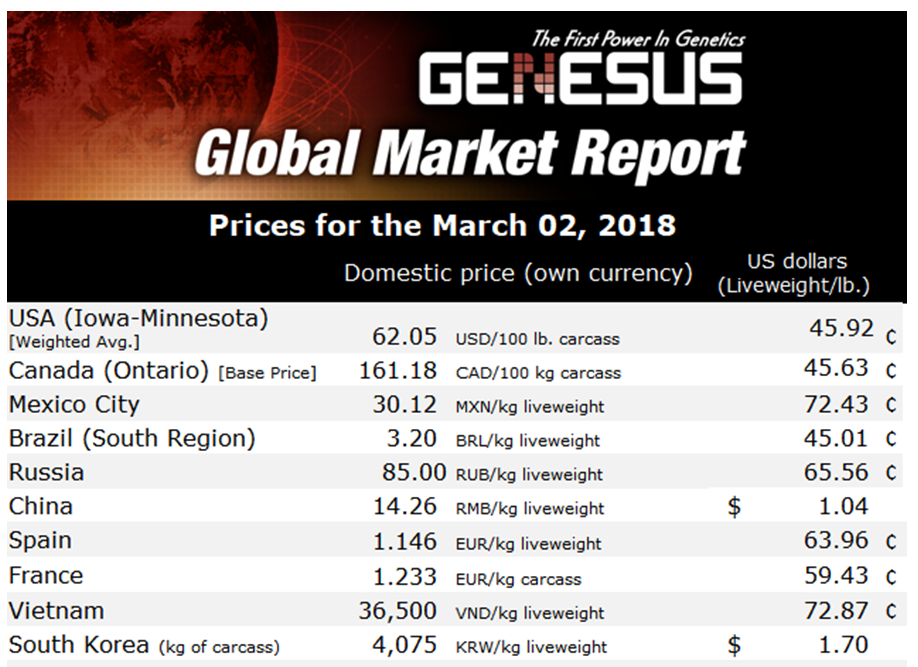

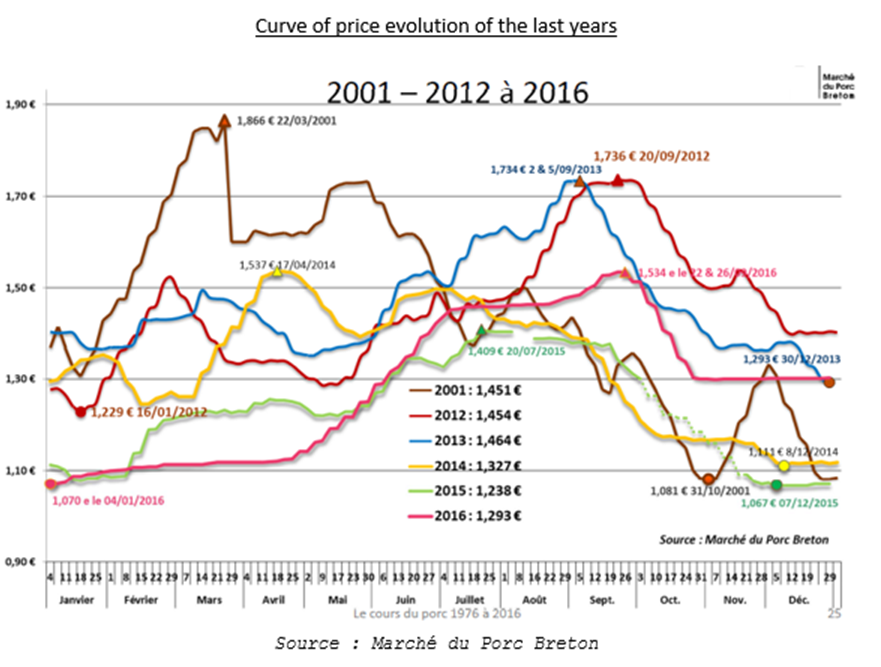

Meat price in France

Comparing to same period last year:

- Average market price in January 2017 was 1.323 €/kg and 1.116€/kg in January 2018 (-19.7 € per finisher pig*)

- Average market price in February 2017 was 1.387 €/kg and 1.152€/kg in February 2018 (-22.3 € per finisher pig*)

- *95kg carcass weight

- France is looking for lean pig and pay carcass regarding the lean yield (TMP). The minimum value for TMP is 56%. Over 56% TMP, producer receive higher premium (plus-value).

- In 2016, TMP average was 61.8% for the female (with 94.5 kg carcass weight average) and 59.8% for the male (with a 94.3 kg carcass weight average).

Meeting about pork fat and meat Quality

In January 2018, IFIP (French Pig Research Center) and INRA (National Institute of Agronomic Research) organized a meeting about pork fat and meat quality. Scientists explained that today in France, due to focusing on leaner and leaner pork since many years, Intra Muscular Fat average is about 1-1.5% - and has now become too lean for meat quality. The IMF should be 2.5% and pH over 5.6-5.7 in order for the consumer to have a good taste experience.

We have heard in the field that the grading carcass system could be adapted in the future (especially for some specific markets). This is a good sign for meat quality, and the Genesus Duroc meets these expectations (IMF and pH).

Genesus in France

Genesus has been operating in France since October 2016 and since November 2017 with own office and French sales team. During the past 18 months Genesus has experienced positive respond and steady increase in demand for our genetics. We have especially seen increasing interest for our Duroc – the Genesus Duroc brings better growth, lower mortality and higher viability, which our first results in France are backing. As any genetic, diet must be adapted to fully express the potential of the animals, and the first results in France prove this: lean premium over 16cts, daily-gain 30-115kg over 990 grams.

The first Genesus F1 gilts are now available in France, and many new Genesus multipliers are planned on the upcoming months to meet the growing demand.

References : Agreste Conjoncture ; Marché du Porc Breton ; “Porc par les chiffres – Edition 2017-2018” IFIP ; Uniporc Ouest