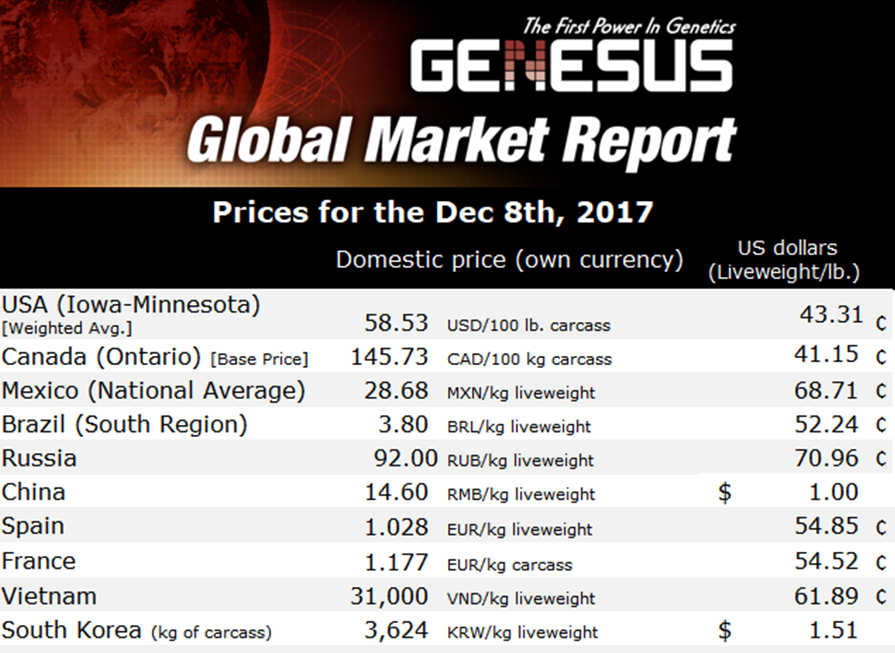

Genesus Global Market Report: China - 8 December 2017

Last month a load of Genesus Purebred pigs arrived in North East China for Guangdong Wens Foodstuff Group Co. Ltd. One of eight large companies that have made this region the growth hot spot for China.by Lorne Tannas, General Manager China, Genesus Inc.

Heilongjiang, Liaoning, Jilin and Inner Mongolia provinces make up the region known as the Chinese Corn Belt. Almost 40% of all China’s corn is raised in this area. Last year this region produced 69 million hogs. The expected output for this region is to hit 120 million hogs annually.

The continued environmental pressure from the government in southern and central China has caused the industry to make these moves north to meet the standards and many farms have been closed. This is expected to continue into 2018. Backyard pigs now represent 52% of pork produced down from 57% in 2015. This would be about 66 million pigs falling out of production.

Labour is a major concern in China swine industry. The one child policy for 30 years has contributed to an aging work force. Young people do not want to live on farms and in isolated rural communities. This means the new farms need to be modernized to reduce labour demands and turnover of staff. The backyard pig population will continue to decline because of labour (aging population) and environmental pressure by the government.

China will have to import pork products in 2018 at record numbers. The import of pork products has a negative effect on expansion, lower price from imports does not help farmer confidence. If China is to meet their pork demand in the future they will have to invest in better genetics. This will greatly improve profitability and enable investment for expansion.

Working with a farmer in a commercial farm in southern China who had 400 sows from poorer genetics he was able to reduce to 300 sows to fill the same finishing farm. He went from 19 PSY to 25 PSY by replacing his genetics. The second half of this is the reduction in days to market or in increased growth in a fixed time. During the growth period this farmer was able to increase his market weight by 10 Kgs during the same growth period. At 14 RMB ($2 USD) per Kilo he realizes an increase profit of 140 RMB ($20 USD) per pig marketed. These returns are significant. This model needs to be replicated in the whole of China if they are to meet the increasing demand for pork.

Growth rate and Litter size are dependent on feed intake. Dr. Derek Petry points out in his Maximizing Profit Requires Optimum Performance presentation that FCR and health are both greatly affected by nutrition and the animal’s ability to cope with stress. This stress is the main driver in FCR (feed conversion ratio). Stress also plays a major role in litter size. Animals with better feed intake grow faster, convert feed better, and stay alive better than pigs with poorer intake of nutrients and suffer during stressors.

The use of better genetics with good feed intake can impact returns from lower mortality by 10 RMB ($1.50 USD), growth rate by 51 RMB ($7.67 USD) and feed ration cost by 24 RMB ($3.60 USD). This gives the farmer an additional 85 RMB ($12.75 USD) to invest into expansion.

Raising pigs should be easy. Genesus is please to be working with our customers to fulfil their needs.