China pork report: Q4 2017

The market overview

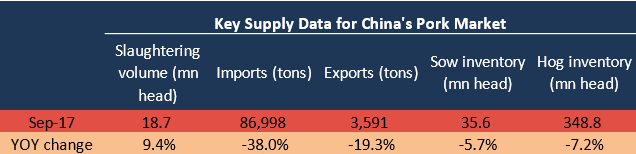

On the supply side, the slaughtering volume of domestic pigs increased to 18.7 million head this September, with a y-o-y growth rate of 9.4%. It is also higher than the average slaughtering volume of 18.3 million head from 2012 to 2016. However, the domestic sow and live hog inventories continued to decrease this September, and both reached a historic low since 2014.

As for pork import, China imported 86,998 tones of pork this September, decreasing by 38% on a y-o-y basis. From this January to September, the total pork import volume was 920,508 tons, declining by 28% compared with that of last year. It was a sixth successive month for the pork import volume being lower than last year.

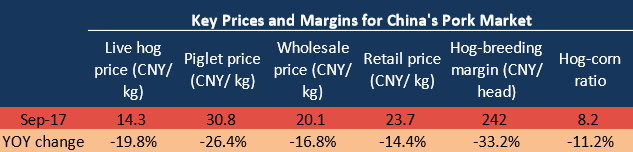

In terms of prices, the live hog price, piglet price, wholesale price and retail price continued to go on a downward trend, but the declining rate was lower than this June. Compared with this June, the piglet price grew by 3.4% this September, but still decreased by 26.4% on a y-o-y basis. During this period, the hog-breeding margin also rose from CNY79 per head this June to CNY242 per head this September. With gradually-recovered pork price and improved hog-breeding margin, Chinese hog farmers are more confident towards the future market.

As predicted in our first quarterly report, the seasonally popular pork products in the previous quarter were hind feet, front feet, neck bone, riblets and pig ears, mainly driven by seasonal consumption and low inventories of these products. For Q1 2018, front feet, front hock, spareribs and pork stomach are expected to sell well. Their consumption is mainly stimulated by China's Spring Festival, especially in Northern China, East China and South China.

Welcome to IQC Insights

Based in Shanghai, IQC insights is a research & analysis company focusing on China’s animal protein industry.

Through on our on-the-ground research approach, including regular market visits, market price tracking and communication with a wide range of official and industry participants, we are able to offer compact, meaningful and data-driven insights.

Our mission is to provide our clients and partners with exclusive and trustworthy analysis and market understanding to guide and inform on major trends and the driving forces shaping the future of China’s animal protein markets.

For further information, please visit our website www.iqc-insights.com.