Pork Commentary: USDA March 1 Hogs and Pigs Report

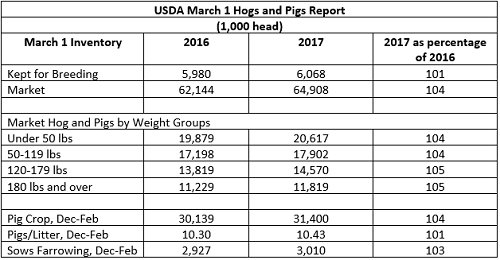

GLOBAL - Year over year, there is more pigs in the market inventory, 2.754 million head. We calculate that’s over 100,000 more per week to go to market over the next half year compared to last, writes Jim Long, President-CEO Genesus Inc.

It’s real good the new U.S. slaughter plants are coming on stream to handle the extra market production. The new plants should handle well over 150,000 head per week and be operating by the fall.

The March 1 U.S. breeding herd is up 88,000 from a year ago, but down 22,000 from three months ago (Dec 1). The major increase in market hog numbers is coming from increased litter size (10.3 to 10.43) and more farrowings per sow (2.927 million to 3.010 million, +3%). The breeding herd we expect to continue a trend to creep higher until we have major financial losses and the older barns will go out of production.

We see some new sow barns going into production now, but let also see some producers quitting for several different reasons. Age of barns, age of owners, continued disease challenges, state of repair, labour issues, etc.

Case in point, some of our associates just visited a 2,000 sow unit that was being liquidated of sows. They toured facilities, equipment mostly worn out, and buildings built in stages and varying degrees of upkeep. Take home message: doubt if this unit will get the investment to renovate to stay in production. It’s easier to give birth than bring the dead back to life.

Brazil

Last week, we wrote about the issues that Brazil was facing with the investigation into meat inspection and subsequent closure of some major country markets to Brazil’s products. We wrote that all exporters live in “glass houses” and issues like Brazil faces could hit any export country. Below is a translated comment from Mario Faccin, a Brazilian producer with 30,000 sows. We have visited Mario in Brazil, and he has visited us in Canada. Like many of us, he is “all in” when it comes to passion and ownership of the pig industry.

“Our company, Master Agroindustrial, which owns more than 30,000 sows, also involved as a pork exporter, expresses our full support to the the "Weak Meat" investigations regarding the misconduct of a few irresponsible agents, and to emphasize that the overwhelming majority of Brazilian meat industry was exempt, even after 2 years of investigations by the Brazilian Federal Police, restricting the diversions to very few industries of low importance. Even so, and because of the way the facts were published, without technical support, which was well placed for you, "we all have glass house" is sheltered by the strength of the Brazilian meat industry, today with customers in more than 150 countries, not counting on the 207 million Brazilian consumers.”

“Also, thanks to the quality of Brazilian meat, supported by the great chain of production, added to the work of the government and the trust that has been gained over more than 50 years on markets worldwide, we have already reestablished almost the entire market or over 98% of it, so this is a proof that attests and rewards the suitability and confidence of the Brazilian meat industry.

We all have glass house and everyone has to take care of it."

United Kingdom

This past week, we spent several days with some British pig producers. The industry is doing fine there now, with decent profits. United Kingdom is a case study on how an industry can be pushed into a competitive disadvantage. In the United Kingdom, there are about 400,000 sows now. There used to be 800,000. Now, about half their pork is imported. There are now numerous rules and retailer dictates on housing. For example, outside sows, antibiotics usage, space, weaning age, straw, non-castrates, toys in pens, etc. All these points increased cost of production, but most of the rules didn’t apply to imported pork from other countries. Over time, the British pig industry lost market share. Now, with Brexit (Britain leaving European Union), no one is sure how imported pork will be handled in the future.

When we look at Britain, we see what has happened to the industry’s competitiveness. We also are in Russia, China, and some other Asian markets. Few issues, such as housing type, antibiotics, space allocation, etc., are a factor in new buildings or production practices. In North America and Europe, we must be aware the many countries we export pork to are not evolving into policies or practices that increase their costs as we are.