Pork Commentary: USDA Pork in Storage Report

US - Last week, the USDA reported the inventory of pork bellies at the end of January at 14,014 (1,000 pounds), the lowest amount recorded since records began in 1957, writes Jim Long President – CEO Genesus Inc.This is down significantly from a year ago, when it was 60,698 (1,000 pounds). Record high belly prices is not an inducement to store belly inventory. Going forward, record low bellies in inventory will support cash belly prices and significantly help the pork cut-out value. Taste and Flavour, which pork bellies bring to the consumer, are a significant signal that our industry must be aware of as we consider the type of pork we need to make available.

Last Friday, USDA pork cut-out wholesale price bellies were at $2.23/lb, hams $0.546/lb. Bellies four times the price of ham. Our industry has focused too much on lean, which has led to insufficient marbling, lighter pork, and lower water holding capacity. Doesn’t take an ag-economist to figure out that better tasting ham could lead to higher consumer demand and higher hog prices. Consumers vote with their money on what they will pay more for. Bellies are having an extraordinary run on demand.

PIC Buys Hermitage

As you all know, we are in the swine genetics business, so we pay more attention to what is going on in this sector than most people would or care. But since this is our commentary, we get to write what we want.

Anyways, this past week Genus-PIC made an arrangement with Hermitage, based in Ireland. It appears that if we decipher their press release, PIC has purchased the intellectual and marketing rights of Hermitage Genetics. It appears to us they did not purchase fixed assets, ie farms or the swine inventory. It looks like going forward Hermitage will give up its selling rights outside of Ireland, Great Britain, and Italy.

Hermitage was not a major player, this deal is dwarfed by Genus-PIC’s past purchase of Genetiporc and NPD. Genus-PIC is relentless in their quest for market growth. They continue to buy up competitors. In the Hermitage case, it appears to us Hermitage will be a de facto selling agent of PIC in three countries. All countries in which PIC has had limited market presence in recent years.

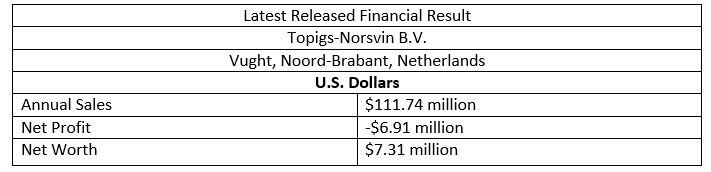

Genus-PIC’s quest for market share has been greatly aided by strong financial results. This is in contrast with swine genetic company Topigs-Norsvin, which had a financial loss of $6.91 million US dollars in their last fiscal reporting year.

Indeed, when we received these financial results, we asked Topigs-Norsvin to confirm them. We were surprised their results were so bad, as they tout themselves as a major global player. We don’t want to be accused of “Fake” news. The financial results were confirmed by one of their executives.

It is interesting that in the latest fiscal year published, Topigs-Norsvin lost $6.91 million US dollars while Genus-PIC had a profit before tax of 49.7 million British pounds. Same industry, different results, different leadership. We have wondered from the beginning, when the Topigs co-op joined up with the Norsvin co-op, how long the financially strong Norsvin would stay in this relationship. Time will tell but a loss of $6.91 million US dollars is not a picture of a business model going well. In our opinion, Topigs needs Norsvin, Norsvin doesn’t need Topigs. A $6.91 million US dollar loss in an industry that is making money is not a good sign.