Dutch Pork Exports Declined in Q3 2016

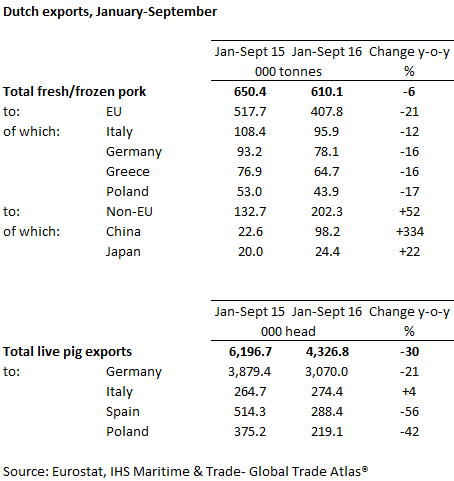

NETHERLANDS - Fresh/frozen pork volumes exported from the Netherlands were back 6 per cent on the 2015 figure during the first nine months of 2016, at 610 thousand tonnes.This decline was particularly driven by the third quarter, where shipments were back 20 per cent on the year. However, higher pig prices during the second half of the year translated into higher average unit prices, minimising the impact of the declining volumes.

The overall value of Dutch pork exports to the end of September 2016 was therefore only back 2 per cent on the year earlier figure, at €1.19 billion.

In terms of trading partners, the third quarter continued trends seen earlier in the year. The EU, while remaining the largest destination for Dutch pork went from a 78 per cent market share in 2015 to only 67 per cent during Q3 of 2016.

Shipments to the key European destinations of Italy, Germany, Greece and Poland were all notably back during this period. Interestingly, volumes to the UK fell particularly sharply between July and September (-56 per cent), likely due to the reduced competitiveness of European pork following the post-Brexit vote devaluation of sterling.

In contrast to the general declining trend, the Netherlands increased shipments to the growing Chinese market throughout the first nine months of 2016. Volumes quadrupled to 98,200 tonnes during this period overall. Although like many European countries, export growth slowed during Q3; “merely” doubling as Chinese import demand fell back and competition from cheaper American pork increased.

Dutch live pig exports were reported back during Q1-Q3 of 2016, declining by 30 per cent to 4.3 million head. Germany makes up 71 per cent of this market, so the 21 per cent drop in shipments to this destination was a key driver to the overall fall. However, it should be noted this decrease was not reflected in the German data.

Dutch live pig exports to most other minor destinations were also notably back, the exception being Italy, which showed a modest 4 per cent increase to the end of September 2016.