Week to Week Variation in US Pork Production Causing Problems

US - For the week ending November 12 the total supply of red meat and poultry is up about 2 per cent from the same week a year ago. However, most of the increase is due to more beef coming to market, writes the Steiner Consulting Group.Pork production was up just 1 per cent while chicken production on a ready to cook basis was down 2 per cent.

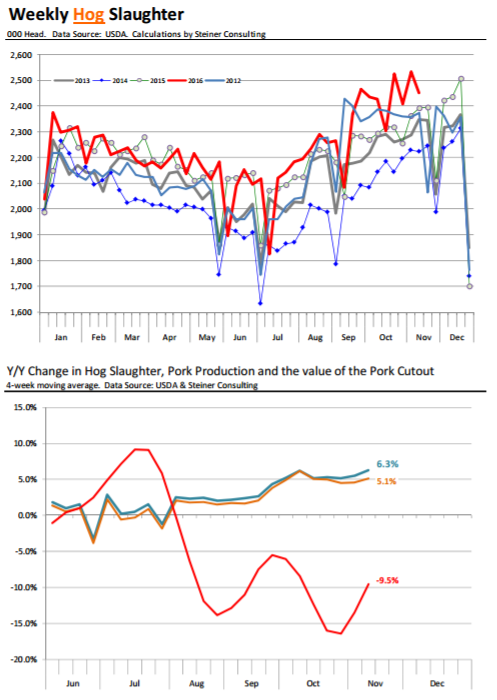

The problem, however, is that there are significant week to week variations in supply and we urge you to consider using 4 or even 6 week moving averages to smooth out some of the variation.

The charts below illustrate some of that week to week variation in the pork market. Hog slaughter last week was 2.452 million head, 2.5 per cent higher than a year ago. However, in the last four weeks, hog slaughter has averaged 6.3 per cent above last year and a number that is also substantially higher than what was projected by the September Hogs and Pigs report. Did the report understate the supply of hogs coming to market this fall?

It may be a bit early to say, especially as it appears producers have been aggressively pulling hogs forward. The average carcass weight of producer cold barrow and gilts currently is running at around 210.6 pounds per carcass, almost unchanged from what it was three weeks ago. Normally we would

expect a 1‐1.5 per cent increase in weights during this time of year. The effect of the flat weight growth can be seen in the second chart to the right. While hog slaughter during the last four weeks has averaged 6.3 per cent above year ago levels, pork production during this period has averaged 5.1 per cent above last year.

Market participants are looking at the increase in production and expressing some surprise that the pork cutout continues to hold above 70 cents. In part the surprise is due to the sharp cutout value erosion that we saw in the fall and then later in October. But it is important to recognize that pork demand receives a strong boost from holidays at this time of year.

The ham primal especially has done quite well and normally continues to perform well into the first week of December. The question for the hog market, at least in the very near term, is whether current cutout values are sustainable into December.

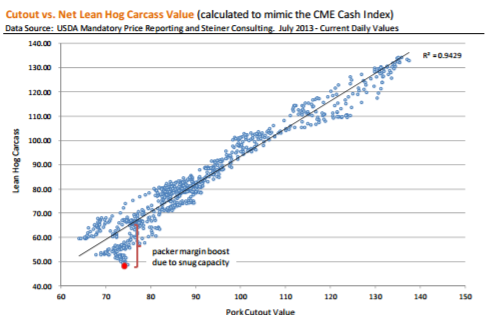

The third chart below shows the relationship between the pork cutout and lean hog values. It is not a surprise that the two move together although they alternate during certain times of the year and also during certain years as to what becomes a primary driver.

Notice in the chart our highlight of where the current value of hogs is relative to the cutout. If processing capacity was plentiful, current cutout values would imply a lean hog carcass price of around $63/cwt.

The difference between this $63/cwt and the current $48 represents the additional money that is going into the packer margins (hog price is a net price similar to what the CME index shows). Are we saying that hog prices are moving higher from here? Not really. The reason why hog prices are trading down here is because there is a real capacity crunch and that is unlikely to be resolved by the end of the year.

In the short term, cutout values in the mid 70s are helping hold cash hog values at around 48‐49 cents. The questions is, what is the outlook for the pork cutout in the very near term, especially if/when hams stage their seasonal retreat. You can run your finger across the trend line in the chart as see the possible implications of a softer cutout value on cash hog prices by the end of the year and in early January.