Heavy Hog Supplies but Limited Processing Capacity is Pressuring Hog Values

US - We have been talking for some time about heavy hog supplies relative to processing capacity. In the short term this has put downward pressure on hog values, writes the Steiner Consulting Group.The base IA/MN lean hog carcass value last night was quoted at $41.23/cwt, 21 per cent lower than a year ago. The CME cash index is not down around 14 per cent compared to last year, in part because hogs sold on some sort of a formula are currently deriving a bit more value than a year ago.

But even as supplies on the ground remain heavy, futures have rallied in the last four weeks and the December contract is now around $8/cwt (+20 per cent) from its low in mid October.

Yesterday futures rallied sharply, in part we think because of short covering but also because of more optimism about both pork demand going into Q1 but also because market participants think producers so far have done all the right things to avert a crash in early December.

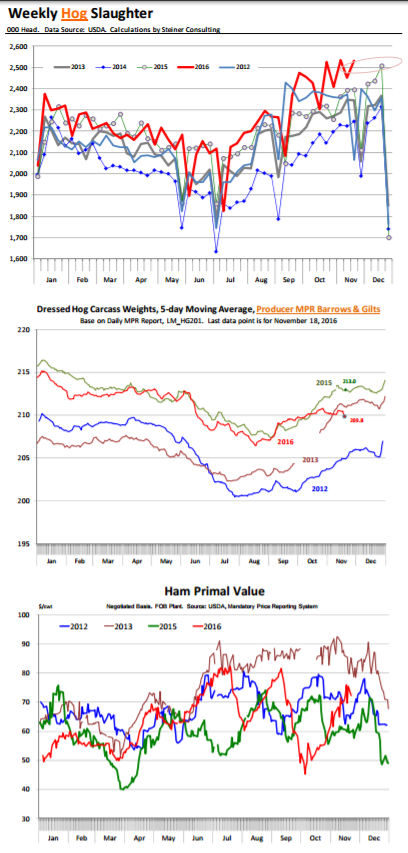

Based on the September Hogs and Pigs report, weekly slaughter for September and October was expected to be up around 4 per cent and then somewhere between 2 and 2.5 per cent in November and December. However, between the first full week of September and last week hog slaughter has averaged 5.3 per cent, quite a bit higher than the H&P estimates.

Does this mean that the inventory survey underestimated the supply of hogs on the ground? It is possible although it appears more likely that the heavy supplies are due to producers pulling their supplies forward. And this is exactly what they needed to do to avert a glut of hogs in the first half of December.

Weekly hog slaughter in three of the last five weeks has exceeded 2.5 million hogs and packers so far have been able to handle the surge in supplies. More importantly, the pork cutout has been tracking near year ago levels despite the larger supply of pork in the marketplace.

The average weight of hogs coming into the market offers evidence that they are being pulled forward. We calculate a 5‐day moving average of producer and packer hogs (see chart for the first).

For the five days ending November 18, the average weight of barrows and gilts was 209.8 pounds per carcass, 1.5 per cent less than a year ago. Lower carcass weights have offset some of the increase in slaughter and pork production since September is up 4.4 per cent.

The rally in hogs yesterday may reflect some optimism about the currentness of hog supplies but there is liƩle question that hog supplies will remain plentiful in the near term. The big unknown is what will happen with the cutout post Thanksgiving and into Christmas. In our mind the value of hams will be critical. This item has been supported, as it normally does, by holiday demand but also because the change to include some of the boneless items has added more value in the short term.

But seasonally ham prices run out of steam once Christmas orders are filled. Last year the ham primal declined about $20/cwt in a two week span between the first and third week of December. A $20/cwt decline in the value of this primal implies a $5 drop in the cutout. Both in 2012 and 2013 we have seen similar pullbacks in the value of the ham primal but this year the decline may not be as large because boneless product is geƫng such a premium.

Export markets remain a key wild card. The strong dollar remains a drag and shipments to China have been quite small so far. On the positive side, the value gap between US and EU pork prices has been widening. Hog supplies in the EU are expected to be down 3.5 per cent in Q4 at a time when US supplies are increasing, maybe enough to tip the balance in favor of US producers for Q1 sales next year (at least that’s the hope).