CME: Hog Futures Post Weekly Declines

US - Last week cash prices in the red meat complex declined with the only exception being the Choice Boxed Beed Cutout (wholesale) value, write Steve Meyer and Len Steiner.In the futures markets, for the week (using average of the daily closes) the October Live Cattle contract fell $4.71 per cwt., while December’s declined by $4.08. The October and November Feeder Cattle contracts dropped by $4.65 and $5.62 per cwt., respectively week-over-week.

In the hog futures, weekly declines were posted for both the October (-$3.12 per cwt.) and November (- $2.06 per cwt.) 2016 contract months. Last week, October hog futures averaged at their lowest level since the week ending October 9, 2009.

Last Friday, USDA’s National Agricultural Statistics Service (NASS) released their Quarterly Hogs and Pigs report (the full report is available here). The USDA reported more market hogs than anticipated caused by sows farrowed larger than NASS had indicated in prior reports and also a bigger than anticipated jump-up in pigs weaned per litter during the June through August timeframe.

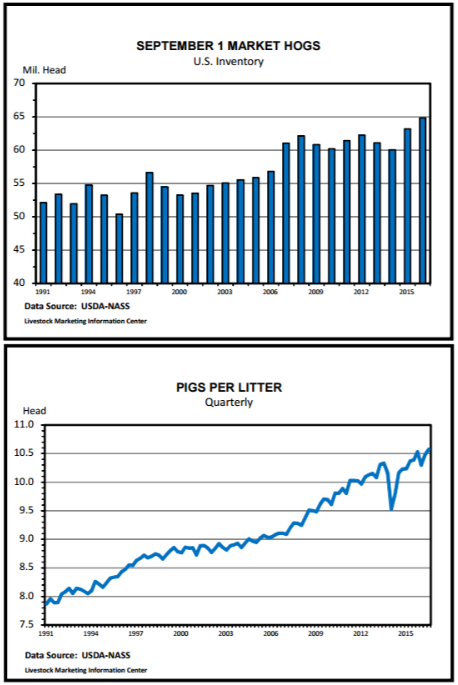

The number of US market hogs as of September 1st was reported at 64.8 million head, up 2.6 per cent year-over-year. That was well above the average of pre-report estimates by industry analysts (up 1.1 per cent) and more than the largest percentage increase expected (up 2.4 per cent). The number of animals kept for breeding was essentially equal to the average of prereport estimates. So, as of September 1st, the number of all hogs and pigs in the US (70.9 million head) was up 2.4 per cent year-over-year and above expectations.

Under accessing the number of sows farrowed and producer farrowing intentions in NASS hog reports has been on-going this year and perplexing. These reports are survey-based and all the largest

operations are requested to participate every quarter along with a sample of all the other hog farmers. Of course these surveys are voluntary and subject to statistical errors. Looking ahead to how the September numbers might change, the reliability estimates provided by NASS give some insight. Reliability estimates show a tendency for the September report to overestimate compared to their final estimate. That is the only comforting output in this report to hog producers already faced with the lowest prices in years.

As stated above, pigs per litter exceeded expectations. For the June through August quarter, NASS reported 10.58 pigs weaned per litter, which was up nearly .2 head or 1.8 per cent from the year earlier level of 10.39 head. That generated a record large June-August pig crop of nearly 32 million head (up 2.0 per cent year-over-year). The impact of Porcine Epidemic Diarrhea virus reducing pigs per litter is apparent in the accompanying graphic, as is the return in recent quarters to the longterm growth rate.

The latest Hogs and Pigs report has analysts raising their hog slaughter forecasts for late 2016 and the first few months of 2017. As indicated in recent editions of this newsletter, hog slaughter has been exceeding expectations; preliminary estimates put September’s Federally Inspected hog slaughter about 435,000 head or 4.4 per cent above a year ago (note that the number of slaughter days was the same in September 2015 and ’16). More hogs than anticipated, it’s now the theme.