Russia Hog Market Report

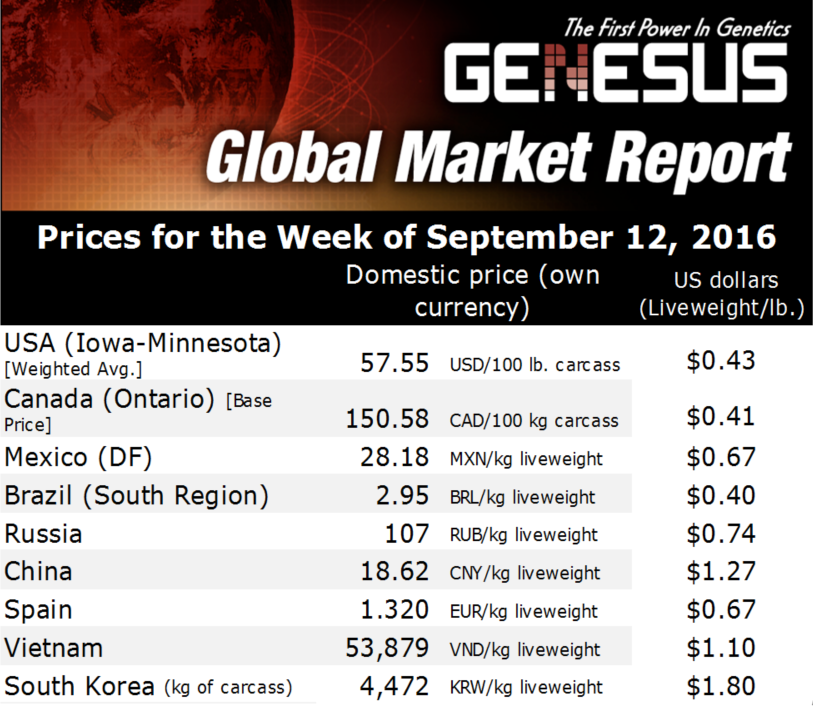

RUSSIA - Current prices in Russia are around 104 Roubles ($1.59) per live kg. This means good producers continue to be making $50 to $70 per pig profit. Despite this, there is a degree of nervousness in the market, writes Simon Grey, General Manager Russia, CIS, and Europe.- African Swine Fever is having its normal summer rampage in Western Russia. Outbreaks are primarily in wild pigs and domestic herds, but some large commercial herds have also been infected and subsequently destroyed.

- Russia is expecting a 15% increasing production this year. This is expected to create market surplus in Russia in the autumn, resulting in considerably lower prices.

- The WTO has found that the trade ban on pigs and pigmeat from EU to be illegal and should be lifted. However, Russia has 60 days to appeal the decision and for sure will!

- Russia’s banking system requires loans for pig farms to be repaid within 8 years. In the first 3 years (the so-called investment phase), there are no repayments. Then, all the capital needs to be repaid over the next 5 years. Although capital repayments are not an actual cost of production, they are a huge demander of cash!

With the average capital cost of a new farm (from green field to point of first sale) being about $9000 per sow. 80% borrowed from the bank is $7,200 per sow.

$7,200 / 5 years = $1,440 per year to repay, or $57.60 per pig assuming 25 pigs sold per sow per year!!

What does this mean for the future?

All of the major Russian producers are either building new farms or plan to build new farms. More good quality production is needed in Russia. These companies are all profitable and have a track record of achieving results, and they can get the finance required to grow. The 80:20 rule will apply. 80% of production in the hands of the top 20 producers!

Domestic production continues to fall, encouraged by a will to stop ASF. On the back of very high pig prices over the past 10 years, there are a number of old and inefficient farms with very high production costs that will be forced to close. New farms will replace both.

At some point in the future, Russia will open its borders for the importation of pig meat.

All of the above means more competition, which means lower pig prices. For the first time ever in Russia, cost of production and exporting pig meat will become very important.

Genetics Role In Sales and Cost

Russia exporting means China and Asia. Genetically, this means one thing. You need to use a Duroc boar. Only the Duroc will consistently give large volumes of carcasses with the meat quality required in Asia. Meat quality means high pH, good water retention, darker colour and good amounts of intra muscular fat.

From a cost of production point-of-view, genetics and more importantly genetic progress is also vital. Many people understand the value of changing genetic suppliers and the initial benefit for production and reducing cost.

However, understanding the value of Annual Genetic Progress is another issue. Remaining competitive requires year on year genetic improvement. Today, the main economic cost drivers remain: more pigs, faster growth rate and less feed used.

More pigs and less feed are very obvious benefits. For some, faster growth is more difficult to understand.

Faster growth means more kg can be produced on the same farm in the same time, either by growing pigs to heavier weights or putting more pigs through the same buildings. More kg = higher income. The second advantage of more kg is lower fixed costs. In pig production, we have only 1 real variable cost. That is finisher feed. Every extra kg we produce needs only food. The cost of the farm, labour, finance, utilities the sow etc…. all remain the same. More kg = higher income and lower fixed costs per kg!

Secondary drivers are earlier maturing gilts. Breeding gilts at 210 days of age rather than 240 saves 30 days-worth of feed. Lower sow and pig mortality, higher sow cull value also reduce cost. Lastly, pigs that are easier to look after (less labour) is also a factor.

The annual Genetic improvement (more pigs, faster growth, less food) achieved by Genesus is Russia is worth 240 Roubles ($3.68) / slaughter pig per year, every year!

Russia’s main competitor for export markets will be the USA, Canada and Brazil. These, of course, happen to be the world’s lowest cost producers. In a commodity market, the lowest cost producer always has the advantage.

These countries understand the value of genetics and genetic improvement. North Americans buy F1’s or GP’s for own internal multiplication. This way, they get known improvement and good return on investment (spending $1 to get $2 back is good business). North Americans do not try to run ‘do it yourself breeding programs’ that do not deliver progress because they are actually more expensive.