CME: Pork Exports Follow a Predictable Path

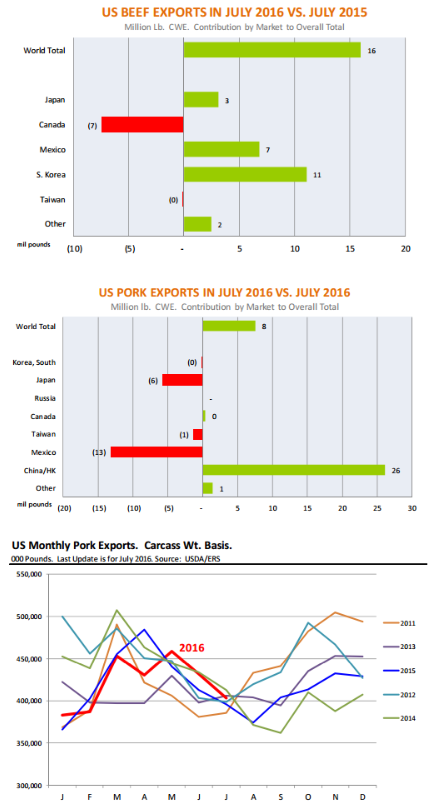

US - USDA ERS released yesterday its calculations of export volume on a carcass weight basis. This is important when trying to understand available supply since production statistics also are reported on a carcass weight basis. Below is a brief recap of the July data and what it tells us about meat supply expansion, write Steve Meyer and Len Steiner.Total beef exports in July were 216.1 million pounds (carcass wt.), 8 per cent higher than a year ago and accounting for 10.7 per cent of US beef production for the month. Year to date US exports have averaged about 9.7 per cent of total US production compared to an average of 9.8 per cent for the same period a year ago.

Exports as share of US production peaked in July 2011 at around 12.6 per cent of production and they have been in a slow downtrend since then. This was largely driven by the reduction in US beef availability and the need to keep a larger portion of our beef supply in domes tic channels (higher prices is one way of doing that).

July export data shows that much of the growth in US beef exports continues to be driven by larger exports to Asian destinations. Exports to South Korea in July were 41.6 million pounds, up 11 million pounds (+36.3 per cent) compared to a year ago.

For the year US beef exports to South Korea are up 38.4 million pounds (+20.6 per cent). Shipments to Japan and Mexico also showed notable growth. Hong Kong was a growth market for US beef in 2014 and 2015 but exports there have slowed down and are down 16.8 million pounds (‐ 10.2 per cent) for the year.

While beef exports in July showed good growth compared to a year ago, the US s till has a negative trade balance in beef. US beef imports for the month were 268.8 million pounds, for a negative trade balance of 52.7 million. To be sure the decline in imports has helped narrow the beef trade deficit from an average of 118 million pounds during Jan‐Jul of last year to 74.7 million pounds this year.

Still, we continue to import more beef than we export and this adds to the overall supply of beef available in the market. Year to date overall beef availability in the domes tic market (production + imports ‐ exports) has averaged 2.095 billion pounds per month, 39 million pounds per month (+1.9 per cent) compared to a year ago.

US pork exports so far this year have followed a somewhat predictable path. Shipments were higher in the spring, in part because of increased product availability but also lower prices, but then declined in June and July.

World buyers knew to stay away from the seasonally highest prices of the year and big futures premiums for July and August also did not help matters. Total July pork shipments, on a carcass weight basis, were 403.5 million pounds, 1.9 per cent higher than year ago but certainly a lot less than market participants were expecting/hoping for.

Growth in exports to China continues to support the market but has not been enough so far. US pork exports to mainland China and Hong Kong in July were 60.95 million pounds, 26 million pounds (+75 per cent) more than a year ago.

Exports to other markets, however, struggled. Shipments to Mexico, still the largest buyer of US pork were 116.6 million pounds, 13 million pounds (‐10 per cent) less than a year ago.

Exports to Japan at 96.5 million pounds were 6 million pounds (‐6 per cent) less than last year. US pork exports will increase in the fall and winter.

The question is how much and whether exports will be able to absorb a large portion of the expected increase in pork supplies. Keep in mind when doing this calculation that you also have to account for the supply of pork coming from Canada, which is larger today than it was five years ago.

In Q4 of 2011, net pork trade absorbed about 19.3 per cent of all US pork production. So far this year, we are at just 16.5 per cent.