CME: Changes to Livestock Mandatory Reporting

US - The CME announcement last week that it would change the settlement procedure for hogs brought to mind a couple of points that may be of interest to our readers, write Steve Meyer and Len Steiner.First, it may be useful to review the changes in the hog report authorised in the 2015 reauthorisation of the Livestock Mandatory Reporting (LMR). The changes were meant to provide a bit more detail as to the way in which hogs are marketed and thus increase transparency, especially since the overwhelming majority of hogs in the US now are traded on some sort of formula basis.

The second point is a review of some shifts that appear to have taken place this summer and the reasons for such changes.

LMR changes per reauthorisation: On September 30, 2015 Congress reauthorised the Livestock Mandatory Reporting for another five years but it also added two additional provisions. Packers are now required to report on “negotiated formula purchases”.

According to USDA/AMS: “the term ‘negotiated formula purchase’ means a swine or pork market formula purchase under which— (a) the formula is determined by negotiation on a lot‐by‐lot basis; and (b) the swine are scheduled for delivery to the packer not later than 14 days after the date on which the formula is negotiated and swine are committed to the packer.’’

These would typically be non‐written or verbal agreements to price a lot of swine based off of an AMS report instead of the negotiated base price.”

USDA price reports, including LM_HG201 used to calculate the cash hog index, now will have two additional price buckets (for producer and packer negotiated formula hogs). As before, all the prices are rolled into a weighted average price. The CME notice reflects the changes in the USDA report.

The reference cash price still is a weighted average number. The hogs reported in the new buckets were previously included in the formulated category. Now market participants will be able to see the magnitude of this marketing channel but it should not impact the weighted average result.

The other change included in the LMR reauthorisation was the requirement that packers will report the price of hogs purchased after the reporting cutoff time will now be included in the morning and afternoon report of the following day.

As AMS notes in their analysis, “this change will increase the volume of hogs reported in the daily morning & afternoon reports and reflect the afternoon‐to‐afternoon daily marketing cycle.” In our view this change has more of an impact on reported pricing since it has the potential to include more hogs in the mix.

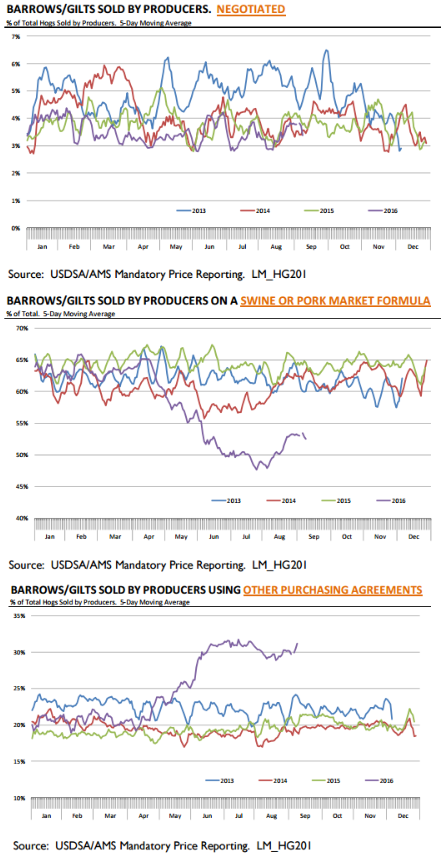

Shifts in how hogs are marketed: The charts to the right show the share of producer hogs marketed through direct negotiations with packers, through a formula tied to the swine or pork market, or through other purchasing agreements.

In addition there is also another category, “other market formula purchase.” Since June there has been a notable decline in the percentage of hogs marketed through swine/pork market formulas and more hogs are now marketed through what is known as ‘other purchasing agreements’. USDA defines the other purchasing agreements as “a purchase of swine by a packer that is not a negotiated purchase, swine or pork market formula purchase, or other market formula purchase.”

Our understanding is that the primary reason for the shift is that producers have increased the number of hogs raised without ractopamine and the formulas used to price these hogs may include a feed component and possibly other factors. But also note the percentage of ‘negotiated hogs’ at 3‐4 per cent, it was +20 per cent in early 2000s.