Rabobank: US Pork Exports Depend on Mexico, Ractopamine

ANALYSIS - Expect ups and downs for pork, poultry and beef animal protein. A new report from Rabobank says pork exports rely on two key factors. Pork

Pork

The headwinds for exports of pork from the US are twofold: Mexico and ractopamine. Mexico is the largest customer for US pork on a volume basis - accounting for about one-third of total exports and by some estimates, one-in-five of all hams produced domestically.

- Mexico has been a strong market for US pork, with growth of 10 per cent per annum in the last four years

- Perennial outbreaks of porcine epidemic diarrhea virus (PEDv) have stunted Mexico's productivity

- Mexican pork producers have experienced very strong margins in light of the favorable prices

Rabobank estimates the domestic breeding herd has expanded by nearly 15 percent over the last two years, lifting domestic pork production and pressuring imports, assuming disease outbreaks are controlled.

The issue of the feed additive ractopamine has been a key barrier keeping US pork from fully participating in the fastest growing pork import market - China - due to China banning the use of ractopamine. With the EU pork industry being fully ractopamine-free and the decline in the value of the Euro, pork exports from Europe to China have doubled in the last three years, and today, the EU controls more than three-quarters of all pork exported to China, said Rabobank.

As more US pork producers adopt a ractopamine-free supply chain, exports to China are starting to climb. However, Rabobank still sees a number of missed trade opportunities in this very important market.

- Rabobank expects an increase in US hog supplies in 2017 and 2018 to help utilize new processing capacity from the US Midwest and from increased Canadian hog imports

- With grain prices at multi-year lows, there is a sufficient level of demand from crop growers to diversify into hog-finishing capacity

- Supplementing the growth in the domestic hog herd, Rabobank expects an increase in the flow of feeder pigs from Canada, driven by the decline in the value of the Canadian dollar

- The end of the US policy of Country of Origin Labeling (COOL) and strong demand for hogs from US packers in 2017 and 2018 as new processing plant capacity comes online will also add to the increase in hog supplies

Beef

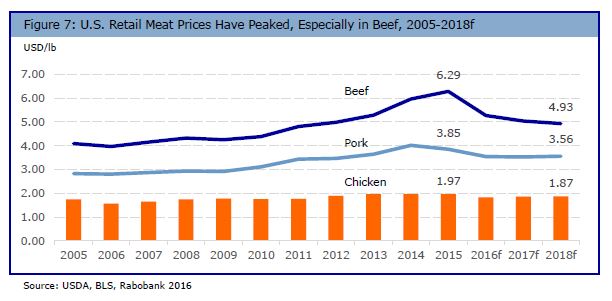

The leader in production growth over the next few years is likely to be beef. Starting in 2016, herd rebuilding finally started to drive increased beef production but will accelerate into 2018 and 2019. Heifer retention and cow herd expansion during the last few years will lead to a 4 per cent increase in beef production by 2017. With the favorable price environment, beef production growth is expected to continue through 2020 but at variable rates.

Rabobank expects US beef trade opportunities for exports and imports to be mixed.

- A flood of Australian beef trimmings entering the market have doubled in the last two years amid drought conditions in Australia

- With Australia reaching a trough in its cattle herd and its beginning efforts to restock, Australian beef exports will decline by double digits in the available lean beef supply in the US, as well as drive export opportunities, most notably to Southeast Asian markets

- Q12016 US beef exports to Vietnam, South Korea, Taiwan, and Hong Kong are all up by double digits and expected to continue

- A new source of competition, for both international market share and domestic consumption, is South America - mainly Brazil and Argentina. Both are approval for US export but are held up by a lack of approved plants and available quota

- It's only a matter of time before South American beef finds its way onto the US market, becoming a serious competitor to domestic production

Poultry

For the US chicken sector, most of the trade issues stem from the discovery and subsequent spread of high-path avian influenza (HPAI) in the fall of 2014, which led to many poultry trade partners banning US poultry products. Despite 2016 having just a single case of HPAI so far, Rabobank still sees the risk of future HPAI outbreaks as being a major concern for US poultry exports.

For most countries, the US ban is regionally based to where the problems have occurred, so this a positive, leaving much of the US open to export poultry. The concern in this scenario is if a state should have an HPAI outbreak, the entire state could lose the vast majority of its export markets. An example is Arkansas, the second-largest chicken-producing state in the US, which experienced this in 2015. According to Rabobank, after a state is found to have a case of HPAI, that state loses as much as 75 per cent of its export potential as a result.

For those customers who haven’t banned US poultry, another issue has emerged for US poultry exports: declining commodity prices.

Countries in West Africa - some are major oil producers and exporters and are important customers for US poultry that have been hard hit by the decline in energy prices over the last two years.

- In 2014, Angola was the second largest customer for US poultry, importing 230,000 tons, or 7 per cent of total US exports

- With falling energy prices, US shipments have declined by 40 per cent

The US poultry sector is also adding new plant capacity to the tune of four or five new plants over the next few years, coupled with capacity expansion at a number of legacy plants. Production profitability has been positive much longer than the normal cycle for the industry, resulting is less producer debt and potentially a significant cash stockpile.

- Two of these new plants will come online over the next 12 months.

- Two are deep in the planning stages.

Rabobank expects US chicken production to increase by 2.5 per cent per annum through 2018, with increased bird weights being an important factor.