CME: Rapid Increase in Hog Slaughter Puts Pressure on the Market

US - At the risk of adding to the confusion and panic that reigns in the current hog market, we have included a bunch of charts to the right that have a lot of colorful lines that run all over the place, write Steve Meyer and Len Steiner.Please bear with us as we look to make a couple of points and review the current state of pork supplies and the potential for demand going forward.

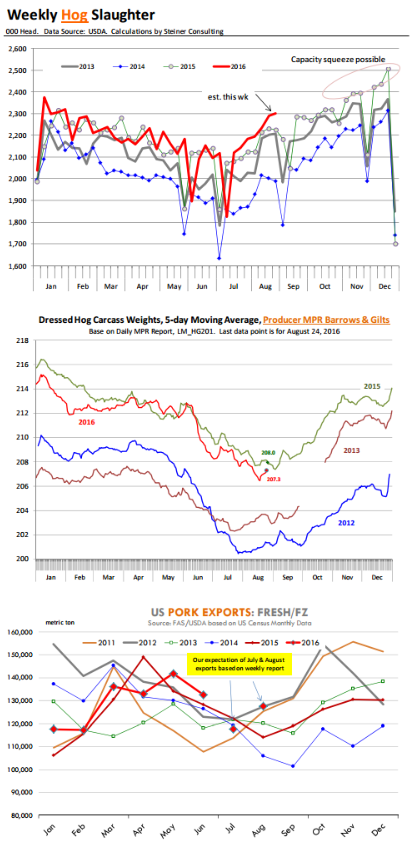

On the supply front: There is little question that the rapid increase in hog slaughter during late July and August has put significant pressure on the market. Last week hog slaughter was 2.291 million head, 2.7 per cent higher than the previous year and about 1 per cent higher than what was implied by the June Hogs and Pigs report. We think this week hog slaughter has a good chance to surpass 2.3 million head given daily slaughter of 435k head on Monday, Tuesday and Wednesday. If slaughter is indeed 2.3 million head (see chart) it would imply a 3.4 per cent jump over year ago levels, pushing significantly more pork to market at a time when Labor Day buys are already completed.

Retailers/foodservice operators are in no hurry to book additional product until they get a chance to assess clearance over the long weekend. In the last six weeks (including this week) hog slaughter has averaged 2.224 million head, 2.6 per cent higher than a year ago and almost a full percentage point or 147k head above what was implied in the June report.

One question that is coming up often is whether producers are pulling hogs forward. It would make sense for producers to pull forward in order to better manage both supplies and weights going into the fall, especially as weather gets cooler and fresh corn contributes to a rapid increase in hog weights. What is a bit puzzling is that weights in recent days have increased even as weather continues to be hot and muggy and slaughter is running at +3 per cent. The seasonal is for hog weights to bottom out sometime in late July and early August and then slowly creep higher. But the recent up move in weights does not argue for pulling hogs forward (seen second chart to the right).

We suppose that the fear/speculation out there is whether actual supplies on the ground outpace what the June USDA report indicated. What if weekly hog slaughter for October and November runs at +3.5 per cent rather than +2.5 per cent?

What kind of supply pressure will this bring and how could this challenge hog slaughter schedules? At this point futures appear willing to price a lot of bearish scenarios and the spot markets are giving them few reasons to thing otherwise.

On the demand front: The weekly pork export sales report that USDA published yesterday was not particularly bearish, in our view. It is difficult to make sense of export pace when looking at weekly numbers so the third chart to the right shows what the weekly data implies for monthly pork exports.

At this point we think the July exports will show a decline from the previous year, which likely contributed to the significant deterioration in hog values for that month. But August exports are expected to rebound and be about 12 per cent higher than they were last year (please note this is for fresh/frozen product only). Some of the differences may reflect the calendar discrepancies but overall the increase in exports has not been sufficient to absorb the rise in supplies. Exports should be notably better than a year ago in the fall and winter. What is more challenging for pork, however, is domes demand given higher supplies and lower prices for comping products? That will be the key factor for Q4 as packers try to push more meat in a well supplied domestic market.