CME: Meat Supplies in Cold Storage Large

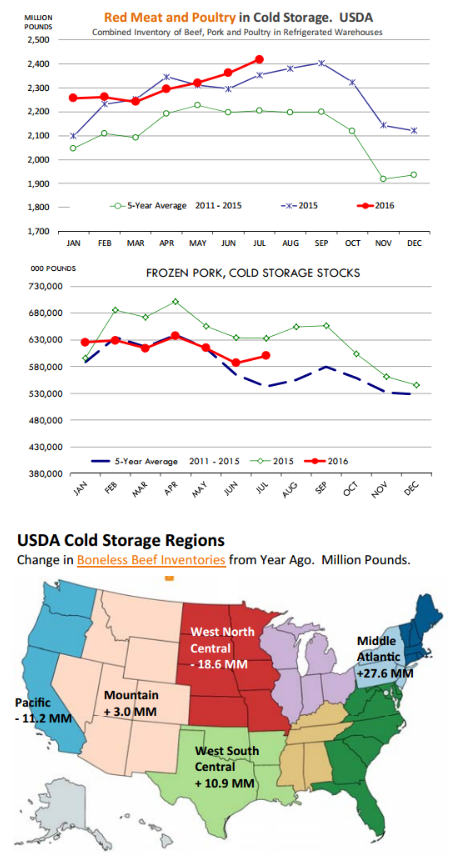

US - Meat supplies in cold storage are large and getting larger, write Steve Meyer and Len Steiner.At the end of July, the combined volume of beef, pork, chicken and turkey was 2.419 billion pounds, 2.8 per cent higher than a year ago and 9.7 per cent higher than the five-year average. This is the largest supply of meat in cold storage since 2002.

Beef: The total supply of beef in cold storage at the end of July was 469.3 million pounds, 2 per cent higher than a year ago and 8.3 per cent higher than the five-year average.

Beef inventories have increased in each of the past two months while normally we see inventories decline by an average of 3 per cent at this time of year. Looking at the breakout of beef inventories by region offers a somewhat confusing picture (map below shows only regions with significant changes from a year ago).

Inventories of boneless beef in the Middle Atlantic region, which includes East Coast port facilities, is up 26 per cent from a year ago and accounts for a big part of the y/y increase in beef stocks.

However, beef imports are down sharply so far this year. And the increase is not due to more beef going to export because most US beef exports go out of West Coast as well as land border points with Canada and Mexico.

The implication, in our view, is that the meat belongs to processors and other end users that serve heavily populated areas along the East Coast.

Pork: We view the latest numbers on pork inventories as somewhat bearish for the fall market, when supplies will continue to ratchet higher.

Total pork in cold storage was 599.9 million pounds, 5.3 per cent lower than the very burdensome levels a year ago but still some 10.5 per cent higher than the five-year average. Inventories increased by 2.3 per cent in July from the previous month when in the past five years we have seen an average 4 per cent drawdown in stocks.

Ham inventories were 188.6 million pounds, 8.2 per cent lower than last year but 14 per cent higher than the five-year average. The seasonal increase in ham stocks was in line with the normal buildup for this time of year.

Pork belly stocks remain large and this helps explain the weakness in the pork belly market in the last few weeks. Total pork belly stocks at the end of July were 50.7 million pounds, 114.3 per cent higher than a year ago and 45.6 per cent higher than the five-year average.

Liquidating 25 million pounds of belly inventories at a time when slaughter is approaching 2.3 million head is a tall task. Belly primal value has dropped from around $140/cwt in late July to around 87 cents last night.

Pork rib stocks are still quite heavy at 90 million pounds, +19.1 per cent vs. last year and 53.8 per cent higher than the 5-yr average.

Chicken: Chicken inventories remain burdensome and they are responsible for much of the increase of meat in cold storage. Total chicken inventories at the end of July were 819.1 million pounds, 6.9 per cent higher than a year ago and 19.9 per cent higher than the five-year average.

Inventories increased by 0.5 per cent in July, in line with the average of the past five years. Breast meat inventories have declined compared to earlier in the year but at 167.7 million pounds they are still 20.5 per cent higher than last year and 39.2 per cent higher than the five-year average.

The inventory of chicken wings in cold storage at 92.7 million pounds is 58 per cent higher than last year and 36.4 per cent higher than the five-year average. Football season cannot come soon enough.