Canada Hog Market

CANADA - When discussing the pork industry I’m reluctant to reference anything as easy. This is a hard game of inches and as any participant who’s has been involved for any length of time can attest it can give you a ride that would make any theme park roller coaster look like a Sunday drive, writes Bob Fraser – Sales & Service, Genesus Ontario.However it seems that for Canada and particularly Ontario the sun and moon and stars have aligned to make it quite a pleasurable time to be in the pork industry. After arguably almost a lost decade the industry had a year for the record books in 2014. 2015 ultimately proved profitable on the year and now 2016 is looking to be a bonus year of profitability.

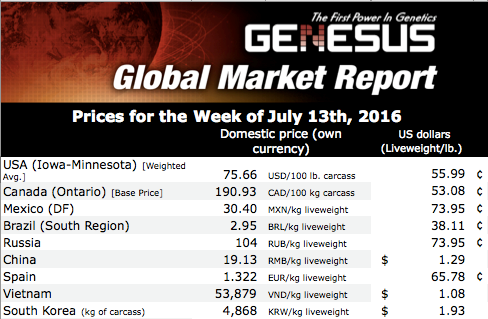

At least in consideration of what was thought to be the traditional hog cycle of profit and loss. See the numbers below provided by Bob Hunsberger, Wallenstein Feed & Supply.

.png)

With farrow to finish producers with average production showing profit over forty dollars and those with excellent production showing profit in excess of sixty dollars would appear to be a very good time to be a pork producer. Also amazingly enough the packer also is remaining profitable. Again the above analysis is showing packer kill & cut margin of $12.28 per pig. Although the producer and packer both making money at the same isn’t unheard of it usually thought they take “turns in the barrel” with losses while the other side makes money. Also for both sides to enjoy such significant margins at the same time is a rare phenomenon indeed!

As well crops in Ontario on balance look good. Some places are certainly dry but most places (if barely) have been getting enough rain such that corn is tasseling out and many reports on winter wheat are exceptional.

Finally this profitability appears to be translating into investment on both the production side and the processing side.

Discussing building projects with one prominent Ontario builder suggests for the first time in a very long time building more sow barns than finishing barns. Not sure that this will result in any net expansion as the “plant” is more than wore out and considerable money needs to be spent just on replacement before any actual expansion takes place.

On the processing side Olymel in Quebec has announced investment in their Saint-Esprit plant. This is the plant that most of Ontario hogs go to that leave the province. Plans should result in weekly capacity expanding to 40,000 hogs from 30,000. Also Conestoga Meats in Ontario (producer owned co-op) have voted on plans for further investment. Will have further details of the significance of this in upcoming commentary.

This could certainly be “a rising tide that lifts all boats” along with upcoming additional shackle space coming on in the US in 2017.