CME: No Big Changes Expected in Hogs and Pigs Breeding Numbers

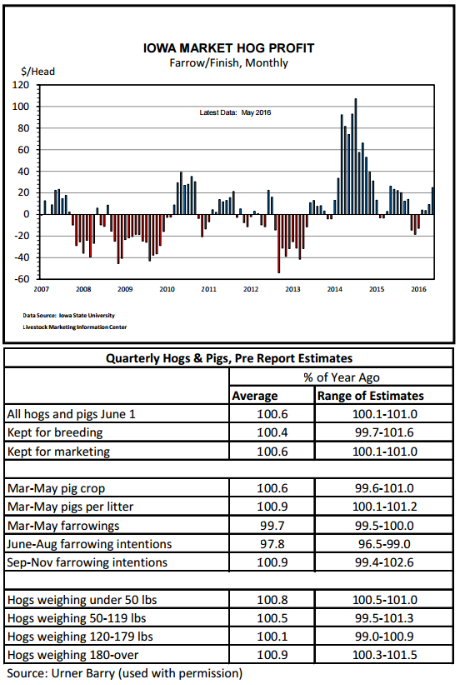

US - USDA-NASS will release the Quarterly Hogs and Pigs report tomorrow. Urner Barry compiled pre-report estimates from a number of industry analysts, write Steve Meyer and Len Steiner.The average and range of these results is in the bottom table. Starting generally, based on the average and range, the number of hogs and pigs kept for breeding is not expected to change significantly. This is supported by gilt and sow slaughter data. The same consistency appears to be in the number of hogs and pigs kept for marketing. This follows current industry production and price trends, which have been seasonally very normal and at relatively adequate or historically normal price levels.

In other words, the current market is not providing significant immediate incentive one way or another to producers to grow or reduce their herds. Moving on to pig crop, pigs per litter, farrowings and farrowing intentions, the more notable numbers here are Mar-May pigs per litter and the Jun-Aug and Sep-Nov farrowing intentions.

The Mar-May pigs per litter estimate has a 1.1 per cent range which is on the larger side. One reason for this larger range, is this number is still rebounding from 2014’s Porcine Epidemic Diarrhea virus (PEDv) issue.

The change in the growth curve of the rebound in pigs per litter is hard to gauge, and at some point this growth curve will slow down but it is difficult to determine exactly when that will be. The Jun-Aug farrowing intentions has been one of the more discussed numbers.

In the last quarterly report, USDA-NASS estimated Jun-Aug farrowing intentions at 96.5 per cent of a year ago, which is a significant drop. Based on LMIC forecasts, and the range of pre-report estimates, expectations are for a reduced year-over-year drop in this upcoming report. It will be interesting to see if the June survey confirms this number.

Lastly, the Sep-Nov farrowing intentions show a wider range also. This is largely due to the uncertainty of how producers will respond to different market signals. On one hand, the possibility of increased corn prices could temper any ambitions of increasing farrowings.

On the other hand, new pork plants will be coming online starting later this year, and live animal supplies are being lined up for those. Additionally, producers experienced some increased profits during the month of May, which could have stimulated farrowing intentions later in the year. These profit changes are calculated by Dr. Lee Schulz at Iowa State University, and can be seen in the top graph. The increase from April to May was based on higher hog prices. These profit reports can be found here.

On the market hog side, year-over-year changes do not show any significant bunching of live animal supplies. The average estimate for supply of market hogs under 50 pounds is slightly higher than the estimate of the Mar-May pig crop. This is largely attributed to year-over-year increases in feeder pig imports from Canada in the weight range. The average estimate of market hogs 180 pounds and over is the largest yearover-year increase, barley, but by the time this quarterly report comes out many of these animals will already have been slaughtered.

Overall, the industry influences right now are the possibility of higher corn price later this summer and fall, new pork plants beginning to come online later this year and their demand for live animals, and recently increased profits. Generally, the breeding herd is expected to hold steady, and more uncertainty is built into the farther out farrowing intentions and therefore live animal supply the end of 2016 and beginning of 2017.