CME: Hog Slaughter Expected to Be Higher This Week

US - If we look at full slaughter day comparisons both beef and hog slaughter was higher than the same period a year ago. Expectations are for cattle and hog slaughter this week to be higher than year ago levels, write Steve Meyer and Len Steiner.Much of the conversation in the market at this time continues to focus around basis levels, both for cattle and hogs. While there were mixed reports as to clearance over Memorial Day we think many market participants viewed business as positive for meat proteins, helped by good weather in heavily populated areas.

Now attention shifts to business over Father’s Day weekend (which is getting more recognition in retail features) and then 4th of July celebrations. It will be interesting to see how ground beef business holds up during this period (the price of 50CL beef will be telling for ground beef business).

Feedlots have done a good job of staying current and marketing cattle aggressively and it is unlikely they will stop now. After all, it is best trying to market cattle now than roll the dice and have to deal with the normal slowdown in business in July and August.

As for hogs, summer futures are on fire once again as market participants consider the impact of seasonally lower hog supplies and a much more robust export market. Bellies, trimmings and hams have been slowly moving up and how well they track the seasonal trend will determine whether futures maintain/add to summer premiums or trim them down, as they have down twice in the last three months.

While much of the attention in the pork market is on exports, we thought it would also be interesting to look at pork import trends and see how much of an offset that represents. One thing to keep in mind is that while the US largely exports pork cuts, trimmings and offals, we import both live animals and pork products.

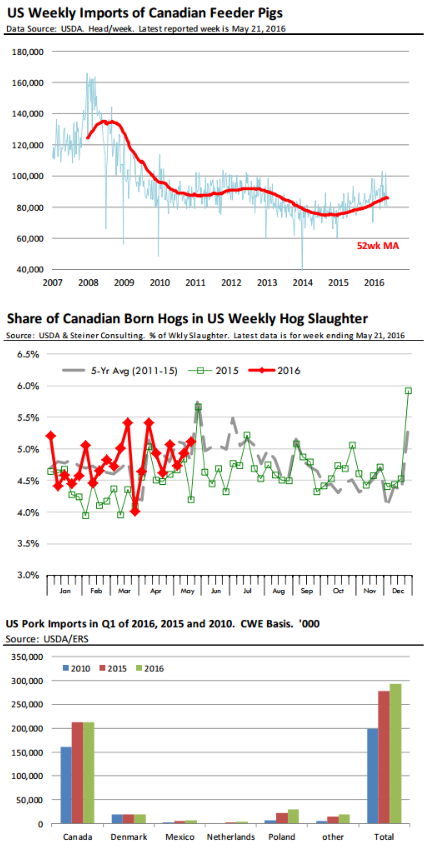

Most of the live hogs that come to the US are Canadian feeder pigs which are finished in US barns.

This used to be a much bigger business but the Canadian breeding herd shrunk by about 25 per cent between 2005 and 2010. The breeding herd there is slowly improving and the weaker Canadian dollar may accelerate that trend.

Weekly feeder pig imports from Canada so far this year have averaged 89,341 head/week, 11.6 per cent higher than the same period a year ago. Imports of barrows and gilts during this period averaged 11,697 head per week, down 11.7 per cent from last year while imports of sows and boars at an average of 8,408 head was down 1.8 per cent.

Total imports of Canadian hogs so far this year have averaged 111,049 head per week, 6.3 per cent higher than last year. The second chart to the right puts these numbers in context, showing that Canadian hogs make up about 5 per cent of US weekly hog slaughter. In addition to more hogs coming from Canada, US pork meat imports also are up compared to a year ago.

Total pork imports in Q1 were 293.3 million pounds (carcass wt.), 5.5 per cent higher than a year ago and 47 per cent higher than in 2010. The biggest reason for the year/year increase in imports are higher imports from Poland. The increase in hog and pork imports will help offset some of our export gains.