CME: Lean Hog Futures Losing Ground

US - Lean hog futures continued to lose ground in yesterday’s trading, with the June contract down 110 points from the previous close and now some 600 points lower than the contract high in mid March, write Steve Meyer and Len Steiner.Most of the value erosion has taken place in the last couple of weeks and a number of factors appear to have contributed to the reassessment of the price potential. First, there was the USDA Hogs and Pig report at the end of March.

On the face of it the report did not contain any significant bearish surprises. But it contained some inconsistencies, on of them being the number of pigs saved per litter during Dec-Feb. This likely caused some in the market to question whether the report undercounted the pig crop, and thus the supply potential for the summer months.

Then, the “strong belly demand” thesis was significantly undermined in late March and early April. In mid March the pork belly primal was priced around $130/cwt, almost double the price from the previous year.

A few days later the belly primal had jumped to $137/cwt and it appeared it would be in the low 140s by early April and probably around $160 by early June given the seasonal trend. But belly values have stalled, they drifted back to the mid 120s and last night were quoted at around $130.

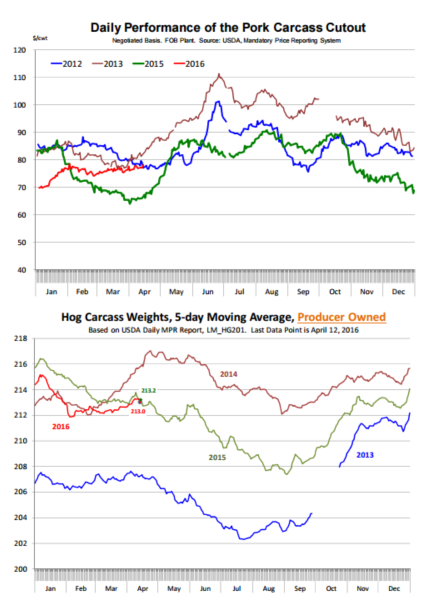

The pullback in pork belly prices has some immediate impact on the current value of the pork cutout, removing about $2 in potential value. But more importantly, we think, it has undermined the $160 price target for June, with prices in the low to mid $140s now a more probable target. The difference of $20 removes about $3 from the implied carcass value in early June and helps explain some recent weakness. Other components of the hog carcass so far have been tracking in line with expectations.

Loins are weak but they should improve considerably by late April as retail demand picks up while slaughter numbers decline. Ham prices so far have performed as expected, with prices weak after Easter but slowly gaining ground in the last few days and likely higher by May as slaughter numbers decline.

In addition to the dynamics in the pork product market, two other points are worth noting. Pork exports were quite positive in Q1 but the pace of growth appeared to slow down in March. Exports to China have been quite strong but a number of other markets, including Mexico, have underperformed. Comparisons to April last year will be skewed by the pork situation last year.

Needless to say, the pace of exports in Q2 will be a critical factor for pork and hog prices over the summer months. The US dollar index jumped the last two days, which may have been a bearish factor for both hogs and cattle.

Still, it remains much lower than it was earlier in the year. Then there is the supply of hogs coming to market in May and early June. The Easter holiday and some plant closures in the last two weeks have kept slaughter under last year and this has showed up in hog weights, which increased in late March. As producers get caught up in their marketings weights should stabilize. But this is one of those indicators that bears watching.

Supplies of hogs on the ground should be plentiful and if weights remain high through May, this would have negative implications for the summer market. Hog imports from Canada remain above year ago levels.

The official monthly statistics showed imports of Canadian hogs in the first two months of the year were up 9% from a year ago. This supply already adds to pork imports from Canada, which are also up. Indeed, the latest USDA WASDE report highlighted this fact. While US pork exports were revised higher by about 100 million pounds, imports were also revised higher by 80 million, thus offse?ng much of the gain. Bottom line: US pork supplies remain plentiful and futures are likely to react quite negatively to any potential signs of faltering demand.