Pork Commentary: China Pork Imports Up 37%

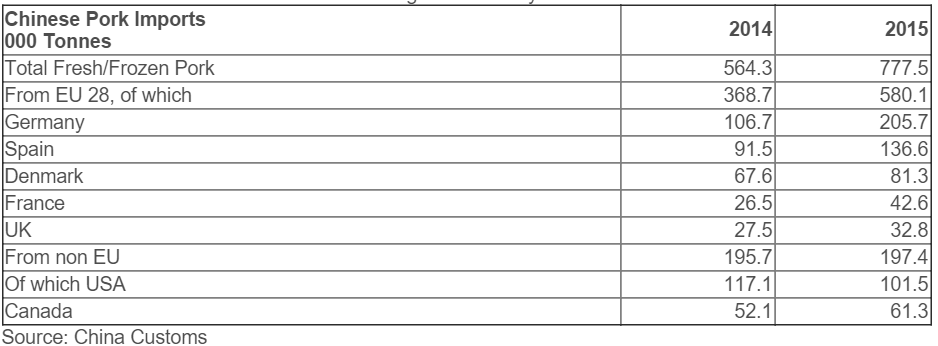

CHINA - For the last few months, we have discussed the huge decline in the Chinese swine breeding herd of over 11 million sows. This led to the hog price in China to increase to $1.25 USD liveweight per pound or an increase of $150 per head in China for a market hog. We predicted a large increase in pork imports to China. The latest China customs statistics bring out this analysis.Our Observations

- Total China Pork imports up 213,000 tonnes or 37% year over year. The increase is roughly carcass equal to 5 million hogs per year. We wrote that we expected the increase of pork imports to China would be approximately the same as the tonnage loss from what PED did to US production in 2015.

- We totally missed the fact the US industry would not be able to capture any of the pork import increase in 2015. Indeed the EU captured all the increase in imports jumping 57% while the US declined 15%. The EU without a doubt outsold the US industry.

- We expect the US port strikes in early 2015 allowed the EU to get a jump on US pork exports just when China started buying more pork.

- The loss of the Russian market to EU due to the embargo created pork tonnage available for China market.

- Europe does not use paylean, subsequently their product was accepted in China quickly. The slow removal of paylean from the US industry stymied export potential.

- There are EU subsidies supporting pork export.

- Market hog prices are similar in US and Europe. There might be a factor of a higher US dollar effecting China’s purchasing power relative to Europe but when hog prices are actually slightly lower in the US relative to Europe when taken to a single currency we don’t think this was a big factor.

- We have to ask the question – where was the NPPC and its vaunted Pork Export arm. When we say arm we mean the arm that continually is patting itself on its back about its export victories. No doubt the US in China lost 15% in sales year over year while Europe gained 57%. No victory for NPPC’s export claims in this scenario. In most companies some salespeople would be looking for other jobs. Hopefully we won’t now be inundated with export spin like we did about what they perceived the glorious “Other White Meat” program that after $1 billion in check off dollars and saw pork lose market share to poultry every year for twenty years. Same scenario in 2015, China lost market share in a growing total demand market.

- We must give credit to European pork producers and salespeople. They saw the opportunity in China, they got there and when the dust settled about 5 million more carcass equivalents got sold.

- We expect with China hog prices in at $1.25 US more pork will go to China in 2016 from Europe and North America. Indeed Canadian packers increased their sales 20% in 2015 from 2014. The rapid elimination of paylean in Canada and Canadian packers marketing efforts paid off.

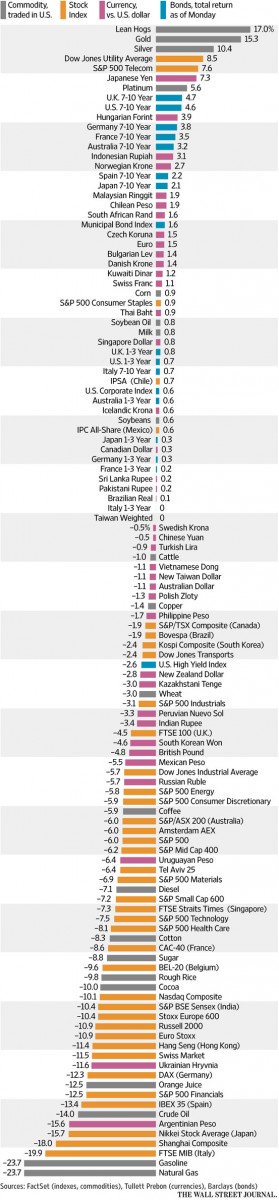

Wall Street Journal

Last week the Wall Street Journal ranked 118 investments in one chart. The chart was from January 1st. What the chart shows is that lean hogs have been the best investment with a 17% increase since January 1st.

Wall Street Journal, Paul Vigna

“Oddly the single best asset class this year, as you can see in the chart below, are lean hogs futures, which has gained 17% through Tuesday’s trading, and farmers expect a spring rally to boot. The gains in the hog market aren’t exactly responding to the macro picture, unlike most other gainers this year. From gold and silver to bonds and the Japanese Yen, safe havens have been in demand.”

Lean hogs, gold, and silver lead the way. We are in a sparkling group. Strange thing is we might be leading but our industry isn’t making much if any money. It shows how a number or percentage cannot tell the whole story. Lean hogs a safe haven? Never thought of that before.