EU and Spanish Pork Markets

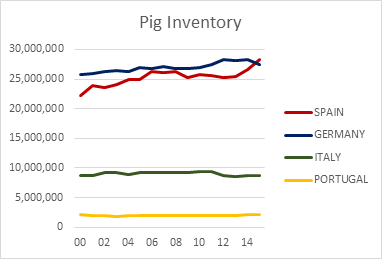

EU and SPAIN - Spain becomes the third largest hog producer in the world (after China and the US) and the first out of the EU, surpassing Germany, writes Mercedes Vega, General Director for Spain, Italy & Portugal.According to the census data of EUROSTAT German pigs to November 2015 it was 27,535,400. He has suffered a decline of 2.8%, which represent 803,000 tons less. Against this, Spain, has a pig population of 28,367,340 heads. It has increased 6.8%, representing 1.8 million more than the previous census. As sows census refers, in Germany has shrank to 1,970,250, compared with a 4.6% growth in Spain reaching 2,466,270 sows.

Spain also ranks fourth at exporter level, behind Germany, the US and Denmark.

As ICEX Estacom (Spanish Institute for Foreign Trade) has published, in 2015 the Spanish meat exports totaled 2.18 million tons, this represents a 15% increase over 2014, for a value of 5,116 million euros. Of this, 1.25 million tons are for pig meat. It is representing an 18% increase over the previous year. With a value of 2,704 million euros.

With regard to products, meat exports have improved in Spain in November 2015, by 5.6% compared to November 2014 due to increased exports, both the EU-28, it has done so by 1, 6%, or to third countries was 22.5%. The pig meat has increased in both volume (15.3%), than in value (5.8%).

With this increase in exports, while France, Portugal and Italy were the main destinations for sales of pork, both fresh and frozen, with a total value of 1,137 million euros (about 624, 261 and 252 million, respectively ), we should emphasize the case of China and Japan.

Spain has become the fourth largest foreign pork supplier in China with a total of 222,000 tons exported (representing over than 58,000 tons more with 35%). And the second largest exporter of pork to China (137,000 tons of meat, 45,000 tons more than in 2014 and representing 49% more), only surpassed by Germany. While in byproducts, Spain is in the fourth position.

Furthermore, it is especially meaningful in the case of Japan. According to a recent study by the Economic and Commercial Office of the Embassy of Spain in Tokyo on the pig market, Spain in 2015 has won the fourth place with a share of 9.3% Japanese market. Growing at a steady pace after 5.1% in 2013, 3.8% in 2012 and 1.4% in 2009.

These achievements in export, there is no doubt that come after the efforts made by the Spanish meat industry with the help of INTERPORC. They have already started its internationalization program in 2016 in Japan and South Korea.

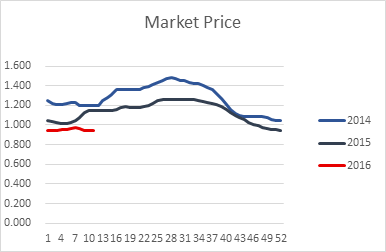

Markets - Spanish price started 2016 below the main reference price of the rest of the EU and, especially, below the German (our main competitor in export) price.

These first months of 2016 have been really complicated, on the one hand there is a considerable increase in production, on the other hand animals have come to slaughter with much more weight (being an extremely mild winter) and although there has been more supply demanded the price has been rising in fits and starts until week 6 (0.02 € cents) and this rise has been respected. But at auction of the week 7 there was no agreement between producers and industry had to resort to the system agreed of Mercolleida. This gave an increase of 0.004 cents €, which has not been respected by the industry. This circumstance had not been given since 2010. This same situation not accept unilateral price, happened in Germany later.

This past two weeks has dropped to 0.939 € / kg live weight (the lowest value since December 2007), this week has risen a thousandth, rising to 0.940 € / kg body weight. This demonstrates how the Spanish market is. The price is the lowest among major producing countries of the EU, Germany is € 1.0 / kg. Spain average so far this year is 0.95, while the value of Germany is 1.0. But the weight is the highest in recent years being at 112,49 KPV (86.42 kg carcass), while a year ago was 108.97 KPV (84.42 kg carcass), two weeks ago, but has now dropped to 111.46 kg (85.99 kg carcass), we are still almost 4 kg body weight over a year ago.

As you can see in the graph, it is a very different situation over the last two years, and keeps moving on the lower stretch of EU prices.