CME: Expansion of Hog Breeding Herd Expected

US - The next USDA update on US hog and pig inventories will be published at the end of this month (March 25) and Statistics Canada will release this week its semi-annual report on Canadian hog and pig inventories, write Steve Meyer and Len Steiner.At this point, futures market participants are mostly focused on pricing prospects for the spring and summer—and for good reason. About 70 per cent of the open interest in the CME Lean Hog futures contracts is in the April, May, June and July contracts.

However, in the next 23 days we should get a clearer picture of the supply outlook for the second half of 2016 and its price implications.

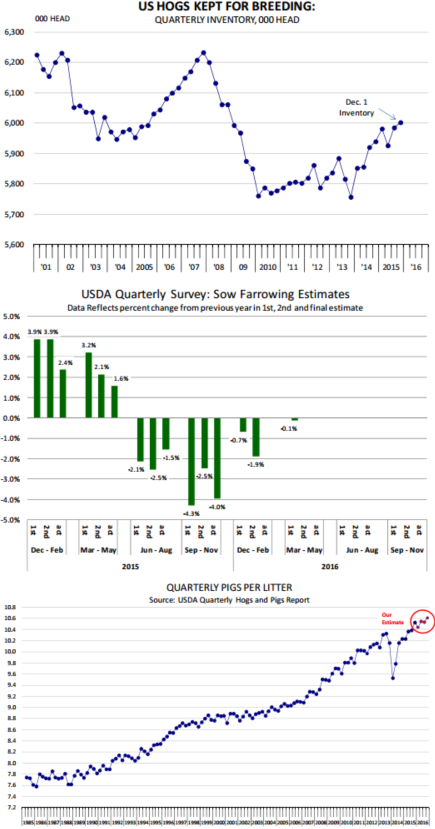

Here’s what we see: The expansion of the hog breeding herd, the lack of any significant disease pressures this winter, and low feed costs have increased the output potential of the US hog industry for the next two quarters. The December 1 breeding herd was estimated at 6 million head, the largest hog breeding herd since Dec 2009. Will the herd be higher on March 1? So far we have not seen a significant increase in the rate of sow slaughter.

Weekly sow slaughter for weeks of Dec 5 - Feb 13 was 603,009 head, just 0.2 per cent smaller than the same period a year ago. We do not have USDA data on gilt slaughter but Ron Plain at University of Missouri works with the industry to track some of these numbers. He shows that year to date (through Feb 13) gilt slaughter is 1.2 per cent lower than the previous year.

Lower sow slaughter and a decline in gilt slaughter normally implies an expanding breeding stock. Now a larger breeding herd does not necessarily imply larger farrowings, as evidenced in the last few quarters.

Still, for those concerned that hog production may be running ahead of industry ability to process these hogs, the ever expanding breeding herd is a cause for worry. The second chart to the right shows the year/year change in farrowing intentions.

USDA gets three shots to estimate quarterly farrowings and the chart shows how those estimates have evolved during the last four full quarters. The first estimate of farrowings for the Mar-May quarter was presented in the December report and at 2.850 million hogs it was 0.1 per cent lower than the previous year.

If the breeding herd is unchanged, this would mean a farrowing ratio (farrowings divided by breeding herd) of 47.5 per cent, which is in line with the trend in the last few quarters. But, the farrowing ratio has been as high as 51 (Mar 2011) and there is certainly risk that farrowing numbers may end up being higher, especially with a larger breeding stock.

But if there is one consistent driver of growth in the hog industry, it is not farrowings but the number of pigs saved per litter (see trend since 1985). It has been a mild winter for the most part and the PEDv virus has not been a concern.

The data from the UMN Swine Health Monitoring Procject, tracking 2.524 million sows, shows disease incidence this year was lower than a year ago. If anything, PRRS this year has been more of an issue but the impact was smaller than in 2011, 2012 or 2013.

As pigs per litter have returned to trend, they imply growth of 1.5-2 per cent for Mar-May and thus, given steady farrowings, a larger pig crop. Last December one slaughter week was almost 2.5 million. Are we going to see a few more weeks like that this year?