Pork Commentary: Total Meat Protein Supply Growing

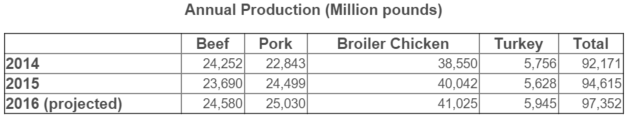

US - The USDA reports that they expect in 2016 that the US will produce 97,352 million pounds of beef, pork, chicken, and turkey which is up a whopping 5,100 million pounds from 2014. We are far from creating a meatless society!The scale of extra pounds of meat and poultry is daunting about an extra 15 pounds per capita in two years.

We better start eating and for heaven sakes exports better be growing. All four meat sectors are expanding production and supply.

The obvious prosperity of America’s Animal Products Industry is real. Profits have led to expansion. Expansion is happening probably despite no knowledge of where the profitable markets are.

There will be markets, the problem is really what the market will pay. Will there be profits or losses?

The European hog sector is losing real money now, about $25 per head. China didn’t liquidate 11 million sows for any reason other than huge financial losses. There is no guarantee or right to profit. The Animal Product Industry is part of Darwinian Capitalism – only the strong survive the cycles.

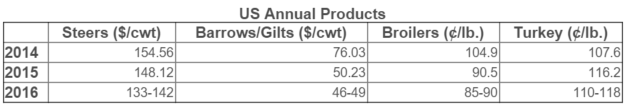

The USDA is projecting prices for the Annual Products Industry significantly lower than 2014.

What the projected prices tell us is that there is an erosion of margin. There will not be significant financial losses at these projected average prices, but there will be billions of dollars working for next to no return. A low margin commodity business is where we are.

If the US dollar stays at its high level compared to other currencies there will be a continued challenge to grow export markets.

The hope for the US pork sector is sow herd liquidation in China and Europe to create opportunities for greater exports as supply expands. It won’t be exports to Europe but lower pork supply in Europe that would lead to less pork to export to China where Europe has 70 per cent of the import market.

If the US dollar weakens relative to Global currencies there is a strong likelihood that the USDA projected prices for 2016 are too low.

An observation we would make is that the higher US dollar and low energy prices are affecting expansion plans. Over the last year we have written about large sow herd expansion plans in Russia and Mexico.

It appears to us the lower peso and the lower hog price in Mexico has if not stopped, certainly slowed new sow barn construction in Mexico. Building and equipment costs have risen and market uncertainty has discouraged expansion.

In Russia low energy prices and the lower ruble value have certainly slowed new sow barn construction combined with hog prices much lower than in the past. The Russian expansion is delayed.