CME: What Caused the Hog Slaughter Crash this Week?

US - USDA reported hog slaughter on Monday at 324,000 head, about 113,0000 head less than what it was the previous week. The reasons for the decline have been widely reported in the press, relating to technical problems impacting Smithfield Foods, the largest pork packer in the US, write Steve Meyer and Len Steiner.We have no special insight as to whether the situation has been remedied at this point. As for the impact on futures markets, we see this as slightly negative/bearish in the very near term (duration is key).

Yesterday hog futures were modestly higher for spring, summer and fall contracts. The only exception was the February contract, which lost about 15 points.

For pork end users, the effect will likely be quite minimal given ample supplies of pork in spot markets and the time of year. The cutout value was quoted slightly higher but the real impact in terms of pork prices will be visible today and tomorrow.

For hog prices, much will depend on the duration of the production disruptions. We view it as generally negative because hog supplies are front loaded and it is imperative for producers to keep hogs moving and stay current.

Last week hog slaughter was 2.375 million head, a very big number for this time of year. Does this mean the USDA Hogs and Pigs report missed the size of the inventory of heavy hogs? Not really.

Actually, so far the weekly slaughter numbers are tracking quite close to what USDA told us back in December. With no slaughter disruptions, the expectation was for hog slaughter in the next two weeks to stay above 2.3 million head. Now the 100,000 hogs that should have been slaughtered on Monday will be processed in the next few days (again depends when the production system normalizes). It is likely slaughter on Saturday will be quite large, possibly over 250k head).

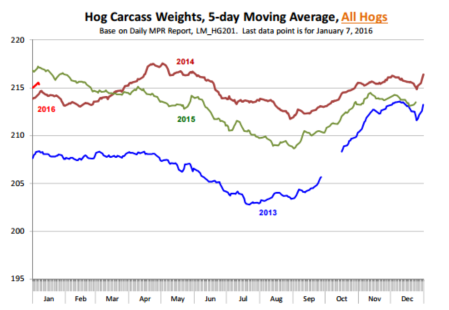

In the meantime, we may see hog carcass weights stay quite heavy and it is the combination of 215 pound hog carcasses and 2.3 MM weekly slaughter that will tend to keep pork prices in check in the very near term.

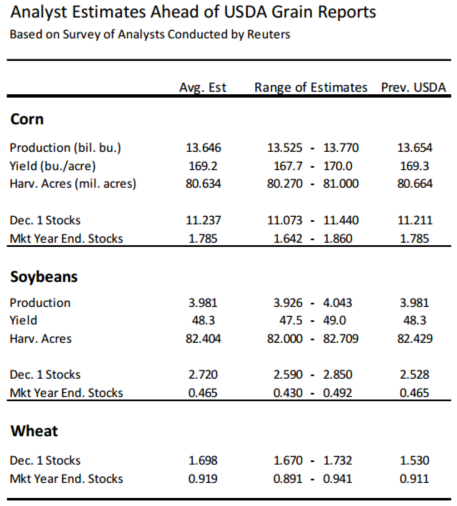

Final USDA grain numbers: USDA will release at noon ET today a number of key grain reports, which will give us the final USDA production estimates for the 2015 production year. The table to the right summaries the results of various polls of analysts conducted by Reuters.

The average of analysts estimates for the most part is very close to previous USDA numbers. Will USDA make significant adjustments to harvested acres? It is a key question that will determine the revisions to the supply and ending stocks data for the 2015-16 marketing year.

Analyst estimates of December 1 stocks for corn and soybeans are quite close to what USDA presented in its December WASDE report. However, estimates of wheat stocks are quite a bit higher, reflecting strong US production and, even more importantly, the erosion in US wheat competitiveness due to ample global supplies and a strong US dollar.