CME: Hog Slaughter in Line With Projections

US - Hog supplies are large but so far the increase in slaughter is in line with the projections from the September Hogs and Pigs report, write Steve Meyer and Len Steiner.That report pegged the inventory of hogs between 120-179 pounds at 8 per cent higher than year ago levels.

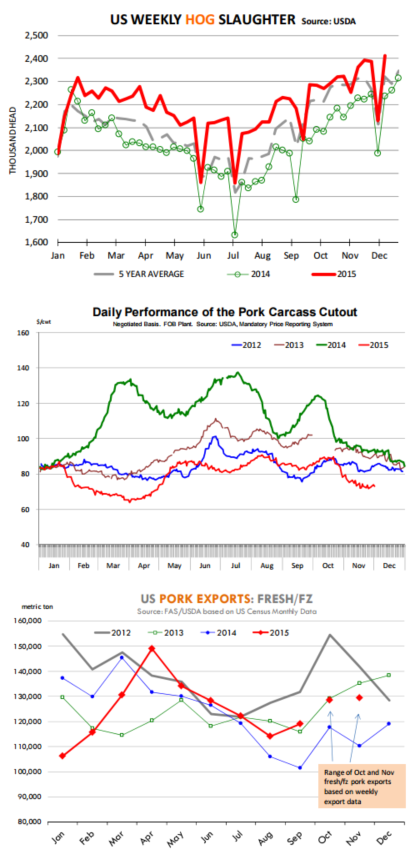

Slaughter for the last four weeks (including our estimate for this week) is projected to be up 7.3 per cent from year ago levels. Hog slaughter in the first two days of this week has been around 438,000 head and we expect total slaughter for the week to be slightly above 2.4 million head.

Slaughter should remain quite large in the two weeks leading to the Christmas and New Year holidays. Market participants viewed as positive the fact that packers had to pay up a bit even as slaughter is approaching the full capacity. But the challenge for the hog market will come after packers have filled holiday orders. The pork cutout continues to be under pressure as large pork supplies hit the market.

Pork production in the last few weeks has averaged 6 per cent compared to a year ago and output is expected to be heavy at least through the first quarter of next year. For the moment it appears that retail markets are fully supplied with pork (and meat protein for that matter).

Pork loin prices have struggled in the last few weeks, which is to be expected with slaughter near all time record highs and heavy hogs coming to market. In the past there has been some expectation that as retailers return to featuring more regular fare in January this tends to support loin prices.

And it is reasonable to expect loins to improve from current levels. But it is unlikely to expect a dramatic improvement in loin values in an environment where we still are going to have weekly slaughter around 2.3 million head in Q1 and dressed hog weights at +214 pounds.

Ham prices have struggled this fall even as turkey breast meat prices have almost doubled in price. Apparently there is only so much substitution you can have at the deli counter or sandwich shops.

Customers looking for turkey sandwiches are quite price inelastic, at least until they see turkey breast meat in the meat case priced as if it is Parma prosciutto. As for pork bellies, prices have come back to earth but the ratio of bellies to hogs is still near all time record highs.

At this point prices for bellies are not lower because demand disappeared, they are lower because supplies are heavy. And supplies will be heavy at least through winter.

There are at least two wild cards for the hog market moving forward. First, are we going to see more PEDv cases this winter? USDA publishes a weekly report on the number of premises infected but it is very difficult for us to discern the number of high risk premises that have been impacted and what this could tell us for future hog supplies.

There are other surveys, which are no longer public, that also track the disease and they show that while there have been a few cases so far, the numbers are not that different than what we saw last year and still below the epidemic threshold.

But PEDv is a factor that bears watching. Second, exports will be key for the pork market in Q1. So far exports are in line with what we saw in 2013 but much lower than in 2012. Much stronger exports are needed in Q1 to help absorb the expected large pork volume.