CME: Hog, Cattle Markets Focused on Supplies

US - Fed cattle and hog futures markets closed last week on a positive note but there is still plenty of uncertainty both in terms of supplies coming to market in the short term but also how meat demand will develop into the holidays, write Steve Meyer and Len Steiner.Some of the most recent economic news have not been particularly positive. Non-farm payrolls were up 136,000 in August and 142,000 in September, much lower than the levels we saw over the summer.

Consumer confidence numbers were positive in September but October estimates are for a notable decline. Speculation about demand will get a bit more traction as we get closer to the holidays.

For the next three weeks market participants will be focusing particularly closely on supplies.

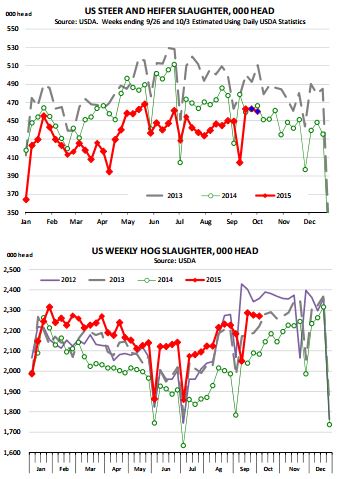

Hogs: Hog slaughter is expected to ramp up in the next four weeks. For week ending October 3 total hog slaughter was estimated at 2.270 million head, 8.9 per cent higher than a year ago.

Since September 1, hog slaughter is up 10.1 per cent compared to a year ago vs. USDA inventory of +180 pound hogs up 9.5 per cent. The inventory of hogs 120 to 179 pounds was projected to be up 8 per cent and this implies hog slaughter as high as 2.4 million in late October and early November.

Hog carcass weights are also expected to move higher. The USDA preliminary estimate of hog weights will likely be revised higher. Based on MPR data, average carcass weights for all hogs now are at 210.6, 1.2 per cent lower than a year ago. By the end of October, hog weights should be around 213 pounds.

The impact of such increases in supplies already is priced in the market, with December hog futures now trading $8 under October prices. Participants will pay close attention to the impact on the hog cutout from the higher supplies and if December hogs do warrant such a steep discount.

Cattle: Fed cattle slaughter for week ending October 3 is estimated at 460,000 head, 1.4 per cent lower than the same period a year ago. This estimate is based on daily slaughter numbers reported by USDA and it is subject to revision.

While packers have certainly ramped up slaughter in the last three weeks, even larger slaughter may be needed to clean up the backlog of extra heavy cattle that are currently on feed.

The total on feed inventory as of September 1 was 9.986 million head, 2.7 per cent higher than the previous year. The supply of cattle that have been on feed for more than 150 days was up 359k head (+7.2 per cent) while the supply of cattle on feed +120 days was up 549k head (+18 per cent).

There is little question that feedlot supplies are frontloaded. The question is how quickly will feedlots and packers be able to work through this supply. So far, it appears to us that packers have gone as fast as they possibly could.

It is very difficult to ramp up slaughter in September with the grilling season behind and parents focusing on the start of the school year.

The cutout lost $40/cwt in about a month. The hope is that demand should improve modestly the next four weeks as end users start to plan for the year end holidays. But as demand increases so will the number of cattle coming to market. There are still some extra heavy cattle that are looking for a home at this point.

While there is an expectation that cattle prices should recover from current levels, the recovery may take a bit longer. In our view cutout values will tell the story.

Sure, packers will continue to run larger slaughter but could come at the expense of weak cutout values. If the cutout values continue to hover near $200.cwt, then talk of a quick turnaround may prove pre-mature and we will likely have to wait until early 2016 for fed cattle prices to recover.

In the very near term, the beef market continues to face headwinds from significantly cheaper competing meats (chicken breasts quoted under $120 by USDA on Friday) and also poor export demand (see our discussion Friday).

And as fed slaughter remains seasonally high for the next few weeks, we should also see more beef and dairy cows come to market. This is normal for this time of year but it will likely add to the overall amount of beef coming to market.