CME: US Pig Herd Sets Record Size

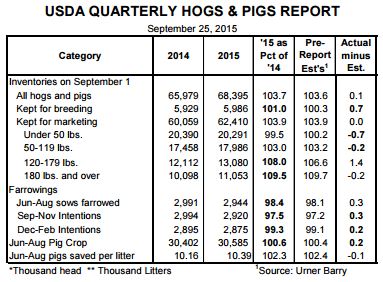

US - USDA’s quarterly Hogs and Pigs report, released on Friday afternoon contained inventory and production estimates that were fairly close to the averages of analysts’ pre-report estimates, write Steve Meyer and Len Steiner.As can be seen at right, only one year-on-year change in the report (the 120-179 pound market hog inventory) differed form the average analyst’s estimate by over 1 per cent.

We would call that a very well anticipated report that leads us to judge the report as neutral for Lean Hogs futures prices in today’s trading.

Some highlights of the report are:

- The number of hogs and pigs on US farms on September 1 was RECORD LARGE at 68.395 million head. That breaks the record of 68.196 million on September 1, 2008 when U.S. pig supplies were large due to herd expansion and the prior year’s introduction of circovirus vaccines that allowed millions of pigs to reach market weight that, in previous years, would never have done so. The market herd of 62.410 million was also RECORD LARGE and the June-August pig crop of 30.585 million head is the second largest on record, second only to last year’s Sep-Nov crop of 30.633 million. A new record is likely for this year’s Sep-Nov crop which will be estimated in the December report.

- The only item that we can see as potentially bearish is the 5.986 million head estimate for the breeding herd on September 1. That figure is 1 per cent larger than last year versus and average of analysts’ expectations of +0.3 per cent. Recall that the sentiment and data entering the report last week were somewhat conflicting with sow and gilt slaughter numbers supporting a small growth rate (which we think the analysts’ estimates reflected) and anecdotal evidence of new sow units supporting a more robust growth rate. The +1 per cent figure probably splits the sentiment but would suggest some unexpected growth for production capacity and longer?term supply increases. We point out, however, that over the past 20 years, the breeding herd has not been a very good indicator of market hog output even one year into the future. PRODUCTIVITY measures have been far more important.

- Productivity measurements in this report are mixed. On the one hand, the average number of pigs saved per litter was record high at 10.39 and 2.4 per cent larger than one year ago. The absolute number represents a return to litter size growth of 2 per cent per year. The year-on-year number is indicative of that trend since we are comparing to post-PEDv (or at least post BAD PEDv) litter sizes one year ago. On the other hand, farrowings for the June-August quarter and farrowing intentions for the next two quarters all appear to be low relative to the size of the June 1 and September 1 breeding herds. And unlike these comparisons for June, it is not high number for 2014 that are causing these year-on-year levels to be low. The intentions numbers for the next two quarters imply slightly lower farrowing rates for the September 1 herd that have been normal over the past few years. The difference is only about 1 per cent but this is a factor to keep in mind for September through February farrowings and, potentially March through August supplies in 2016.

- Market hog inventories are still very much front-loaded relative to one year ago. The 180-pound and over inventory of 11.053 million head is still 9.5 per cent larger than last year — and that figure agrees very well with slaughter since September 1. The next weight group is up 8 per cent. Those two groups will constitute slaughter through early December. These numbers do imply about 1.5 per cent larger slaughter for that period than did the June estimates for the same pigs (ie. lighter-weight inventories on June 1).

- These estimates imply Q1 through Q3 2016 market hog supplies MUCH LIKE those of 2015. In fact, our preliminary estimates would put slaughter hog numbers the first half of 2016 virtually even with this year and Q3 supplies up about 1.3 per cent from 2015. Those numbers leave 2016 pork supply changes primarily a function of average slaughter weights. We expect those to continue lower in Q1 but to be very similar to this year form there forward, assuming of course that next year’s crops are more or less “normal”.

- The big risk going forward is still PEDv. Improved knowledge, better biosecurity, tighter management and vaccines that help boost immunities all pushed case accessions and death losses far lower last winter. Current thinking is that this winter may be a bit worse because a good number of those immune sows are gone. But few, if any, expect anything like the losses of 2013-14, PEDv’s first winter in the US.