CME: Export Numbers Look Supportive for US Pork Market

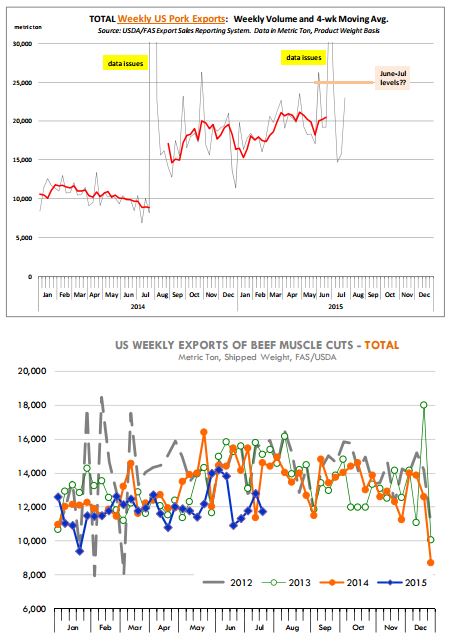

US - The weekly USDA numbers have been released and they were supportive of the pork market (with some big caveats) but they continued to show a notable slowdown in beef shipments, write Steve Meyer and Len Steiner.Pork: The chart shows weekly pork exports shipments in 2014 and 2015 as well as a four week moving average. You will notice two major breaks in the data.

First, in July 2014 USDA dumped a lot of data that should have been reported weekly but were not. The pork export sales report is quite new and there is still a lot of confusion as to who is supposed to report and who is not.

There is also confusion as to the products that need to be reported since the report only covers pork muscle cuts.

Still, after the inclusion of more exporters, it appeared that the pork data became consistent enough that it could be used to track overall trends.

Then came the week ending June 25 when weekly pork exports jumped to 38,843 MT after having averaged under 20,000 MT for much of the year.

Was this a new shift in the data? Was a new major importer included in the data set that was not there before? We don’t know but hope to find out from USDA at some point. After that big data dump, however, weekly exports dropped to around 15,000 MT.

For week ending July 23, weekly shipments were around 22,973. If we were to normalise for the big jumps in the data, it would appear that in June and July weekly pork shipments were around 25,000 MT compared to around 19,000 to 20,000 MT in April and May.

Normally pork export sales are lower in June and July, reflecting the seasonality in pork production. That exports appear to be up is a positive thing for the market going into the fall, when by all measures pork supplies will be some of the largest in recent years and we need all the demand we can get.

Now for the caveats. It could be that for all the talk of export orders, the recent numbers reflect a change in reporting rather than better export business. Reported weekly shipments to China so far have been quite mediocre. The real strong export numbers have come from Japan and Mexico.

The reason why China export speculation is bullish—and there is plenty of talk about China, it is because it would represent new business at a time when the established large buyers, Mexico and Japan, are already receiving significant volumes.

The weekly export data also is showing more pork going to smaller markets. Again, if the data is correct, then this would represent an expansion in demand for US pork and a broader base for shipments during the surge in supplies this fall.

Beef: As we have noted before, beef exports to Asia and North American continue to struggle. The main challenge remains the Hong Kong market, which in the last four reported weeks has averaged just 939MT/week.

For the same period last year, weekly shipments were 1,832 MT, down 49 per cent. Exports to Japan during the last four reported weeks are down 25 per cent and exports to Mexico are down 28 per cent.

South Korea remains a bright spot in an otherwise gloomy export report, with exports in the last four weeks 2,728 MT/week, up 38 per cent.

Average weekly beef export volume in the last four weeks was 11,912 MT, down 15 per cent compared to the same period last year. Beef exports in the second half of last year were quite strong despite a sharp reduction in volume.

In part this was due to a surge in exports to Hong Kong. The lack of Hong Kong business as well as ongoing weak sales to North America imply lower beef exports for the remainder of the year and, more importantly, lower value for items that normally fetch a premium in export markets.