CME: Consumer Confidence High

US - In spite of what we perceive to be a great deal of naysaying and doomsday thinking, consumer attitudes and confidence remain strong, write Steve Meyer and Len Steiner.That is our conclusion based on last week’s release of June measures of consumer attitudes and the National Restaurant Association’s Restaurant Performance Index for May.

Some highlights of the various reports are:

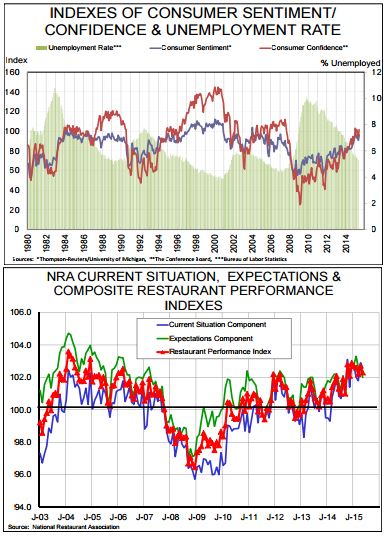

- The University of Michigan’s monthly Index of Consumer Sentiment gained 5.4 points in June to reach 96.1, its second highest level (second only to January of this year) since January 2007. The UM report points out that “Consumers voiced in the first half of 2015 the largest and most sustained increase in economic optimism since 2004.” Does that sound like things are going south in a handbasket? We suppose consumers could possibly just be being duped but it is difficult to fool everyone for very long and this surge is now in its 7th year.

- The UM index’s gain was driven primarily by its Current Situation component which gained over 8 points to reach 108.9. The Expectations component gained as well but its 3.4 point increase is rather modest by comparison.

- Recent UM surveys have “recorded those same records when consumers were asked to evaluate prospects for the national economy, their personal finances and buying conditions.” The report’s authors expect consumer spending to be the driving force of the economy the rest of this year. Their data indicate spending growth of 3 per cent for 2015.

- The Conference Board’s Consumer Confidence Index followed May’s modest gains with a robust increase of 6.8 points in June to reach 101.4. That figure is also the second highest (to January of this year) since 2007 for this index. The CCI’s Present Situation Index increased from 107.1 in May to 111.6 in June while the Expectations Index gained over 8 points to reach 94.6.

- The Conference Board reported that “consumers have grown more confident about the current state of business and employment conditions” and concluded that this confidence could lead to more willingness to spend in the near term. Sound familiar?

- The survey respondents were more upbeat on almost every measure in the June survey. The per centage expecting improved business conditions over the next 6 months grew from 16 to 18.5 while the per centage expecting them to worsen fell from 11.3 to 9.8. The share expecting more jobs increased from 14.7 to 17.8 while the share expecting fewer jobs fell from 16.6 to 15.1.

- One exception to the optimism was expectations for income growth. The share expecting it remained at 17.5 per cent. The share expecting incomes to fall, however, did decline slightly from 10.7 to 10.2 per cent.

The Restaurant Performance Index declined slightly in May but remained solidly above the 100 level that indicates growth. The May index was 102.3, down 0.4 points from April’s 102.7 but still slightly higher than last year’s 102.1.

This marks the 27th straight month in which the index has exceeded 100 and the 8th straight month in which it has stood above 102. Both the Expectations and Current Situations components declined slightly.

It appears to us the restaurant performance is stabilising — but at a VERY HIGH level relative to history. Holding these levels is a positive development!