CME: High US Pork Supplies Overwhelm Market

US - High pork supplies are limiting prices, but packers are struggling to find cattle, write Steve Meyer and Len Steiner.Hog/Pork Markets: The pork cutout seasonally moves higher in late June but large pork supplies appear to have overwhelmed the market.

A number of items that normally support the cutout at this time of year have failed to generate much upward momentum. The loin cutout last night was quoted at $92.49/cwt, modestly lower from the previous close but still about $9/cwt lower than where it was on May 20th.

In 2012 and 2013 (we are leaving 2014 out given the PEDv issues), the loin cutout gained about $20/cwt between late May and June 30th, thanks to strong retail promo- tions for the 4th of July weekend.

This year, however, those promotions do not appear to be providing much of a lift for loins. This could be because of weaker consumer demand. It may also indicate that supplies simply are too large and thus lower prices are required to clear the market.

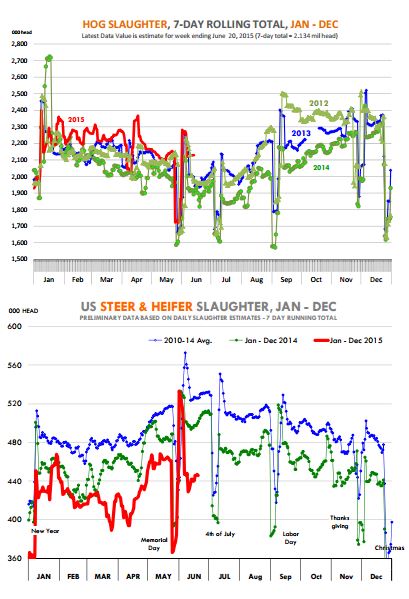

Hog slaughter for this week is estimated at 2.134 million head, 13 per cent higher than a year ago. Last year PEDv sharply reduced slaughter. However, current slaughter is also 8 per cent higher than in 2013 and 8.8 per cent higher than in 2012.

Hog carcass weights are starting to come down but they still remain about 3.5 per cent higher than in 2012 and 2013. So with 13 per cent more pork in the market than in 2012- 13, there should be little surprise that prices for items such as loins or hams currently are tracking 15-20 per cent lower.

Again, we are comparing to those years recognising that last year markets were severely stressed by PEDv induced shortages. Going into July, the expectation is for hog slaughter to ease a bit lower, somewhere in the 2 million head/week range.

Also, hog weights should continue to decline as hog weather normally starts taking a toll on animals. Note that we are saying should—there is risk associated with these estimates and the latest slaughter numbers have been a bit on the high end of forecasts.

Exports remain a key wild card and weak ham values are a warning sign that Mexico purchases may have slowed down. For now, pork supplies appear to be burdensome, especially for items that carry a large portion of the cutout such as loins and hams.

As a result, futures have sold deferred contracts aggressively, anticipating even larger supplies coming to market later this year. There is little talk at this point about PEDv.

It is summer and normally the number of PEDv cases declines but the issue could crop up later in the fall. If cases start to crop up, we will likely see risk premiums return for late spring and summer 2016 futures.

But we are still a few months before markets focus on that topic. For now, markets remain concerned about current pipeline supplies and the ability of domestic consumers to absorb the additional supply.

Cattle/Beef Markets: The situation in cattle markets is a mirror opposite of what we are seeing with hogs.

Packers are struggling to find cattle and have sharply reduced slaughter in the last few months. With three days already reported by USDA, we think this week steer/heifer slaughter will be around 446,000 head, 11.7 per cent lower than a year ago.

For the second week in a row, packers reduced Wednesday slaughter, this time by around 15,000 head in an effort to stabilise the cutout.

The 4th of July weekend is around the corner and this should be the time when retailers are aggressively looking to fill the meat case with ground beef and steaks.

It is somewhat worrying to us that the price of grinding beef items, both 50CL fat trim and 90CL beef, has failed to generate much of a momentum. And this despite the sharp declines in slaughter we have seen the last two weeks.

As with pork, beef exports will play a critical role. Demand from some Asian markets appears to have slowed down and this has further dented packer returns and their ability to bid on cattle.

Futures saw the recent drop in slaughter as bearish for nearby cattle—a signal that packers will keep slaughter light rather than bid themselves deeper into the red.