CME: Canada, Mexico Move Quickly on COOL Tariffs

US - Following the recent World Trade Organisation (WTO) finding against the US on Country of Origin Labelling (COOL), Canadian and Mexican authorities are quickly pushing to get approval to impose tariffs on US products, write Steve Meyer and Len Steiner.On Thursday, June 4, the Canadian Minister of International Trade, Ed Fast, the Canadian Minister of Agriculture and Agri-Food, Gerry Ritz, as well as the Mexican Secretary of Economy, Guajardo Villareal issued a statement regarding the next steps in the process.

They are asking the WTO for a special meeting in which they seek approval to impose annual tariffs on a variety of US products.

Canada is asking for C$3 billion (approx. US$2.4 billion) in retaliatory tariffs while Mexico is asking to impose tariffs worth US$653 million.

We have not seen a recent list of the products that will be impacted by the higher tariffs but earlier reports (in 2013) included fresh/frozen beef and pork as well as offal products.

We expect the list of products affected will be made public once WTO has approved the Canadian and Mexican request. At that point, we will likely learn when the tariffs will come into effect.

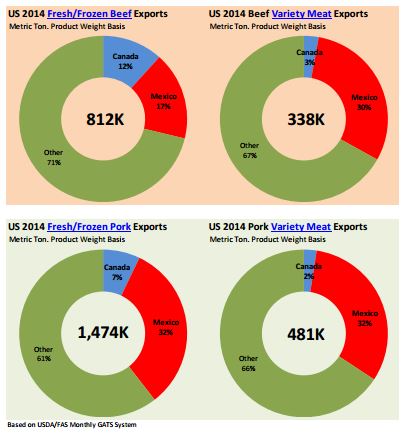

Canada and Mexico account for an important share of US beef and pork exports. In 2014, the US shipped 811,650 MT of fresh/frozen beef.

Exports to our North American partners were 233,651 MT or 29 per cent of the overall total. Exports of beef offal were 337,919MT, with Mexico alone taking about 30 per cent.

Pork exports are even more substantial, and we would argue more important in this context. Total US shipments of fresh/frozen pork in 2014 were 1.474 million MT.

Exports to Canada and Mexico accounted for almost 40 per cent of total shipments. At this point it does not seem to us that futures are pricing the potential impact of such tariffs.

We cannot speak to a general consensus but it would seem that the odds favour a repeal of Country of Origin Labelling, particularly given the quick vote in the House Agriculture Committee to repeal the law.

The vote came two days after the WTO announcement and it shows there is consensus among US lawmakers to do away with this law.

Recap of Markets for the Week

Cattle slaughter last week was 550,000 head, down 10.8 per cent compared to the same week a year ago.

Steer and heifer slaughter for the week is estimated at 449,000 head, down 10.5 per cent from last year while cow/bull slaughter at 101,000 head was 9.8 per cent lower.

Cash trade was particularly light over the weekend as both packers and feedlot operators are at a standstill.

The choice beef cutout dropped sharply on Friday, losing $3.8/cwt. The select cutout also was down almost $3/cwt.

Choice beef prices have declined rapidly in the last two weeks, largely due to the drop in the value of middle meats.

Good foodservice demand and Memorial Day promotions forced the loin and rib cutout values sharply higher in May.

However, now those promos are done and retailers are shifting to less expensive cuts, which has negatively impacted the lofty prices of ribeyes, strips and top butts.

The price of 50CL boneless beef, which accounts for as much as 10 per cent of the carcass, also has declined sharply.

Lower prices for competing meats, such as pork loins and chicken breasts, appear to be taking their toll on ground beef. Last night, 50CL beef closed under 85 cents, compared to over $1 that was trading just a few days ago.

Pork supplies appear to be heavy and there are indications producers are behind in their marketings. The average carcass weight of all hogs (producer+packer) currently is 214.1 pounds, down about 2 pounds compared to a year ago but some 8.3 pounds (+4 per cent) compared to the same period in 2013.

Hog slaughter last week was 2.124 million head, 10.2 per cent higher than a year ago and also 7.3 per cent higher than in 2013. Export demand will be key for the pork market this summer and fall as supplies are expected to remain burdensome.