German Pork Producers Suffer from Low Prices

GERMANY - German pork producers have been hit hard by the Russian import ban, with prices low and many producers losing money.German pig prices have been low so far this year. The ongoing impact of the Russian import ban is one contributory factor, along with subdued consumer demand across the EU and an increase in production.

The situation might have been even worse were it not for strong sales to Asian markets, helped by the weak euro.

Nevertheless, most producers have been in the red since last summer and there are signs that this could lead to tighter supplies from the end of this year.

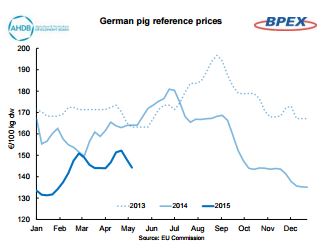

Having peaked at just over €1.80 per kg in June 2014 (already nearly 20 cents lower than the previous year’s peak), the German reference price fell sharply in the autumn, reaching a low point of just over €1.30 per kg in January.

Although it has recovered somewhat since then, the price remains well below the levels of recent years; in the latest week it was 20 cents lower than a year earlier at around €1.44 per kg.

German piglet prices have followed a similar downward trend, falling from over €60 per head a year ago to €37 at the turn of the year.

Some seasonal recovery has bought the average price back up to about €51 per head but that is still 15 per cent down on last year’s spring peak.

Cull sow prices have fallen too, with the latest price of €1.03 per kg less than three-quarters of its level a year ago.

This negative picture is a result of a combination of factors. The Russian import ban is undoubtedly one of them. In 2013, Russia was Germany’s largest non-EU market, although it only took 5 per cent of all German exports.

Equally important, though, is a rise in production at a time when EU consumer demand has also been subdued. Between August 2014 and February 2015, Germany slaughtered 3 per cent more pigs than a year earlier, with pig meat production up 4 per cent.

Between August 2014 and February 2015, Germany slaughtered 3 per cent more pigs than a year earlier, with pig meat production up 4 per cent.

Nevertheless, things might have been even worse. The weak euro and supply shortages in the US have allowed Germany to find new export markets, particularly in Asia.

Excluding Russia and Belarus, German sales to non-EU countries rose by nearly 40 per cent last year and this trend has continued in early 2015.

With EU sales also up 3 per cent, this meant that Germany was able to increase its pork exports again last year, despite the loss of the Russian market. However, it is worth noting that some of the products previously shipped to Russia have proved difficult to sell elsewhere.

This means that, despite the higher volumes, the value of pork exports fell 5 per cent last year to just under €3.8 billion.

Although the weak euro has helped support export sales, its impact on the German industry is not all positive.

Since cereals and oilseeds are generally priced in US dollars, producers have not benefited fully from falling feed prices. This has limited any drop in production costs and means that most German producers have been losing money since last summer.

Finishers are reported to be losing money at a rate of €5-10 per head based on current prices, although margins were better last autumn due to the low piglet price. Breeders have been affected much more severely.

German market intelligence organisation AMI estimates that the cost of piglet production is around €60 per head. Even with weaner prices having recovered during the spring, producers are still losing significant amounts on each animal.

This comes on the back of sustained losses over the last year, on a scale not seen since 2011.

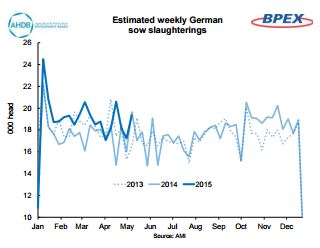

Further evidence of these difficulties comes from a rise in sow slaughterings. Weekly figures from AMI show that cullings have been well ahead of year earlier levels since October.

With sow prices low, this suggests producers are reducing their herds. Over this period, around 40,000 more sows have been slaughtered than the previous year.

This is equivalent to around 2 per cent of the German breeding herd.

It remains to be seen what impact this will have on the size of the German sow herd; the situation will be clearer when the next census results are published in August. However, it could mean that supplies will start to tighten again later in the year.

While this might eventually provide some support to prices, most forecasts suggest they will remain subdued, although probably staying above the low points of late-2014.