Falling Chinese Pig Herd Presents Export Opportunities

CHINA - The falling size of the Chinese pig herd could present export opportunities for other countries, according to analysts from UK pig industry body BPEX.With around half the world’s pigs, developments in China have a big impact on global trends.

While much of the world was experiencing high pig prices and low input costs during 2014, the reverse was true in China. This led to a sharp fall in the breeding herd and is projected to mean lower production this year.

While slower economic growth may limit demand to some extent, there will probably be greater export opportunities as a result.

During 2014, Chinese pig prices averaged 10% lower than the previous year and were 20% down on the inflated levels seen in 2011.

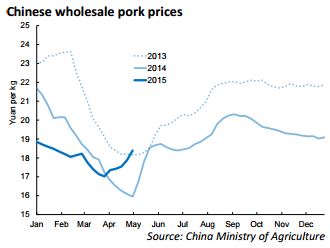

Wholesale pork prices followed a similar trend during 2014 and are averaging 3% below 2014 levels so far this year. However, wholesale prices have picked up of late, which is probably the first sign that the expected tightening of supplies is beginning to affect the market.

While pig prices were low in 2014, prices for maize (the main feed grain in China) were much higher than on global markets.

This meant that the Hog:Corn price ratio has been below 6:1, normally regarded as the break-even level for Chinese pig producers, for over a year. As a result, many producers have been reducing the size of their sow herds.

Reduction in Chinese Pork Production

Latest figures from the Chinese Ministry of Agriculture show that in March 2015, the sow herd numbered 40.4 million head. This was around 7.5 million (15%) fewer than a year earlier.

To put this in context, the US sow herd, the second largest in the world, numbers less than 6 million head.

Many of the losses will have come from ‘backyard’ producers or small farms, rather than the more efficient commercial farms.

Nevertheless, the overall pig herd was 10% down on a year earlier as productivity gains have been insufficient to offset the decline in sow numbers.

A drop on this scale will inevitably mean lower production, especially as last year’s output included heavy sow slaughterings. However, modern farms finish pigs quicker than traditional ones, so the fall in production won’t be as high as 10%.

Latest USDA forecasts put the decline at just 1% for the year as a whole, although the drop is likely to be sharper than this in the second half of the year.

Nevertheless, given the scale of the market this equates to around 600,000 tonnes less pig meat. This will inevitably mean that pig and, hence, pork prices will rise.

Given that economic growth is slowing, this may mean that any rise in pork consumption is modest – USDA forecasts virtually no change between 2014 and 2015. Even so, the shortfall in domestic supplies creates an opportunity for exporters with access to China.

This opportunity may be greater still given reports that the Chinese government is cracking down on smuggling of meat into the country.

Chinese Pork Imports on the Rise

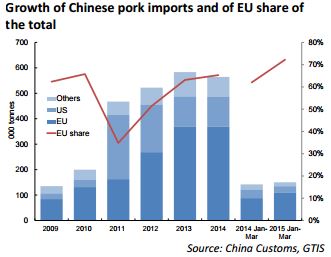

Last year, China imported 564,000 tonnes of pork and 814,000 tonnes of pig offal. With most involving products with little value elsewhere, this trade is important for exporters looking to maximise carcase values.

Nearly two thirds of pork and over half of offals were sourced from the EU, a market share which has risen over time.

Last year, the UK was the sixth largest supplier of pork to China and the ninth largest supplier of pig offal, with market shares of 5% and 2% respectively. This emphasises how important the Chinese market is to the UK industry.

Even in the first quarter of 2015, there were signs that Chinese imports were starting to pick up.

During these three months, shipments were up 6% year on year, to 150,000 tonnes. This represents the highest first quarter figure on record.

With shipments typically picking up in the second half year, when domestic supplies are set to be at their tightest, this adds weight to forecasts of a strong year for imports.

The EU’s market share increased further in early 2015, topping 70% for the first time. While this was partly due to port labour disputes disrupting US exports, the weak euro has ensured EU product remains competitive.

With the Russian market still closed, China could, therefore, provide a lifeline to the EU market.

Despite not having the same exchange rate advantage, the UK could also benefit from the higher Chinese demand, providing some relief from the challenging conditions on the domestic market.