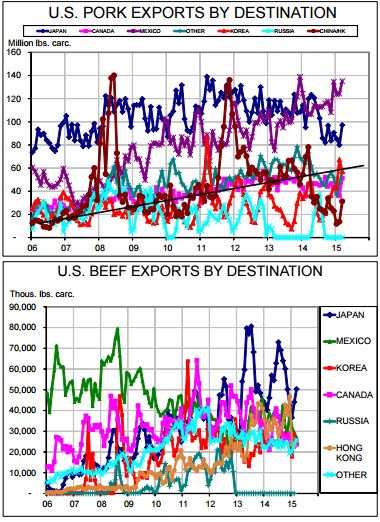

CME: US Pork, Beef Exports Grew in March

US - US pork exports grew sharply in March while US beef exports grew slightly but grew none the less, write Steve Meyer and Len Steiner.Those would be the two major conclusions that we drew from the March trade date released Wednesday by USDA’s Foreign Agricultural Service and Economic Research Service.

The increases were expected due to the tentative agreement reached in late February by West Coast pork operators and dock workers.

The work slow-down that the agreement ended had backed up exports of pork, beef and a myriad of other goods and slowed imports of many goods as well, among them beef that was primarily headed to grinding operations.

Some highlight of the March trade results are:

- Pork exports surged 16.7 per cent from February’s level to hit 440.2 million pounds, carcass weight equivalent, in March. The month’s total was still 8.9 per cent below last year’s March total but we must recognize that March 2014 shipments were the 6th highest monthly total on record. This March’s shipment are the highest since that large total one year ago.

- March exports grew from one year ago for Canada (+11 per cent), Mexico (+26 per cent), Hong Kong (+54 per cent), South Korea (+22 per cent) and the Caribbean (+21 per cent). Pork shipments to China (-72 per cent), Japan (-19 per cent) and Other markets (-23.3 per cent) continued to lag year-ago levels. The combined 31.25 million pounds, carcass weight, shipped to China/Hong Kong in March was 60 per cent lower than one year ago.

- The year-to-date pork export total made up some of the ground that it had lost in January and February. YTD shipments now total 1.165 billion pounds, 13.4 per cent fewer than last year’s 1.345 billion pounds during January through March. Among major U.S. markets, only Mexico, South Korea, Canada and the Caribbean have taken more U.S. pork this year. YTD shipments to China/Hong Kong are down 72 per cent from 2014 levels. YTD shipments to Japan are over 20 per cent lower than last year.

- Pork imports are up sharply (30.9 per cent) from one year ago through March. In-shipments have been larger from every major US supplier with Hungary and Holland leading the way in percentage terms. Canada accounts for 73 per cent of all US pork imports this year and those shipments are 28 per cent larger than one year ago. None of this should be a surprise given the strength of the U.S. dollar.

- Pork variety meat exports surged by 60 per cent from February levels and were 32.8 per cent higher than one year ago. The value of variety meat shipments were sharply lower, however, falling 16 per cent from February and 26 per cent from one year ago. YTD pork variety meat shipments are up 3.9 per cent in volume but down 7.5 per cent in value.

- Beef exports grew in March but by only 4.1 per cent from February levels. The month’s total was 185.3 million pounds, carcass weight, 6.6 per cent less than one year ago. The month’s shipments brought YTD beef exports to 526 million pounds, carcass weight, still 9.8 per cent fewer than one year ago. That figure, however, is the smallest YTD decline observed so far in 2015.

- March beef exports exceeded year-ago levels for Canada, Japan, South Korea and Other markets but fell well short of last year’s level for Hong Kong and Mexico. This marks the sixth straight month for which shipments to Mexico have been smaller, year-on-year. It also marks the smallest monthly beef export total for Mexico since May 2013.

- March beef variety meat exports were 9.2 per cent higher than in February but still trailed year-ago level by 6.8 per cent. YTD beef variety meat shipments are down 9.3 per cent. YTD variety meat export value is 18.4 per cent higher than in 2014.

- Beef imports rebounded in March, pushing the YTD total to 526 mil. lbs. carcass weight, up 47 per cent from one year ago. Shipments from New Zealand and Mexico were record large in March. Imports were larger from every major US supplier except Argentina which was shown as having shipped no beef products to the US in March.