CME: Pork Supplies Up

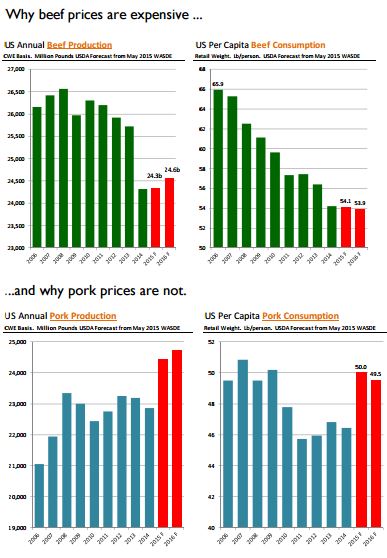

US - Pork supplies are growing whilst beef supplies are declining, leading to differences in the market patterns of the two meats, writes Steve Meyer and Len Steiner.The charts help explain the dynamics in the US beef and pork markets in 2015 and give us a glimpse as to what to expect next year as well.

The per capita consumption charts are particularly interesting, illustrating the steady decline in beef availability at a time when pork supplies have rebounded rapidly and are expected to grow further in 2016.

The consumption number is often a source of misunderstanding and misinterpretation, particularly when it is used as a proxy for demand. Indeed, even the word consumption is somewhat of a misnomer since a decent amount of the beef and pork produced is never consumed.

Some of it perishes on the way to the consumer and some of it perishes in the back of the refrigerator or is left on the plate and invariably finds its way to a landfill. A more appropriate designation is ‘per capita availability’ - a supply measure.

USDA updated its forecasts for 2015 and it also produced its first forecast for 2016 livestock and grain supplies/use.

The red bars on the charts reflect these latest forecasts. For beef, USDA revised up its beef production forecast for 2015 by 58 million pounds and it now expects beef production for the year to be 24.339 billion pounds, slightly higher than in 2014.

Higher carcass weights, which are running some +3 per cent over last year are expected to offset the lower slaughter numbers. It remains to be seen whether the higher output numbers materialise.

Pasture conditions are off to an excellent start this year and this could continue to slow down the flow of cattle onto feedlots and also will limit the number of heifers available for placement.

Fed cattle slaughter is down sharply in the first four months of the year and feedlots will continue to hold on to cattle as long as they can given the limited availability of feeders. Maximising pounds on the carcass has become critical for feedlots at this point, especially with lower feed costs.

Imports are expected to further bolster US domestic beef supplies this year. USDA now expects beef imports to be 3.116 billion pounds (carcass wt basis), 206 million pounds more than the previous forecast and 5.7 per cent higher than a year ago.

Earlier in the year, a number of analysts, including us, expected beef imports to be lower this year. Larger Australian beef shipments were the main reason for the big increase in imports in 2014 and the pace of shipments was not expected to be sustained.

However, ongoing large slaughter numbers in Australia and a strong US dollar continue to bring significant supplies of imported beef into the US. Based on US customs data through early May, US beef imports are up 36 per cent from the same period last year.

Beef exports also were revised slightly higher but at this point the US is a large net beef importer by about 655 million pounds.

As for next year, USDA expects beef production to increase by about 230 million pounds, or 0.9 per cent. However, the increase in production will be offset by lower imports, which are expected to decline 296 million pounds, or 9.5 per cent.

Australia has been depleting the cattle herd at a brisk pace and that cannot continue forever. Weather and currency remain key drivers for imports and we don’t know which one is harder to predict.

Pork production in 2015 is now forecast at 24.414 billion pounds, 161 million pounds larger than the previous forecast and now 1.55 billion pounds (+6.8 per cent) higher than a year ago.

The last time we saw a bigger swing in pork output was in 1998 when production jumped 1.7 billion pounds (+10 per cent) from the previous year. This is by far the largest amount of pork produced in the US, surpassing beef production for the first time ever.

Pork exports were revised up and are now slightly higher than a year ago. Per capita pork availability is now forecast at 50 lb/person, +7.6 per cent higher than a year ago and 7.2 per cent higher than in 2013.