CME: Nearby Hog Futures Improve

US - Lean hog futures traded mixed yesterday, with the nearby futures closing up for the day while deferred contracts were modestly lower, write Steve Meyer and Len Steiner.Hog futures have mounted a significant rally in the last few weeks on improving seasonal demand in retail markets, good export sales and a return to a more normal order flow from processors.

Since late March, the June lean hog futures contract has gained $11/cwt (+15 per cent). Hog prices in the cash market have fared even better.

The IA/MN lean hog carcass price (wt. avg basis) closed last night at $80.75/cwt, unchanged from the previous day but up some $24/cwt (+42 per cent) compared to where they were trading at the end of March.

Futures have been trading behind the cash hog market for the last few weeks, reluctant to place significant premiums on summer contracts given expectations of larger supplies.

But as wholesale prices have continued to trend higher and packers have become more aggressive in chasing hogs summer futures have had little choice but to oblige.

So what explains the rapid improvement in hog prices and what should we expect for the remainder of the year? A number of factors are at play but the first thing to consider is that prices in late February and March declined by more than what fundamentals warranted.

Supplies were indeed larger than a year ago but they were not as burdensome as markets traded. Comparisons to 2014 are a bit skewed due to the effect of PEDv so it is best to compare to 2013.

Average daily pork production in March was around 96 million pounds compared to around 92 million pounds in March 2013, a 4.3 per cent increase.

Exports did not perform well in March so that left some additional pork to be absorbed in the domestic market but again this was not enough to justify hog prices trading in the 56 cent area compared to 78-80 cents in March 2013.

Producers were looking to become more current so they sold hogs aggressively and that explains some of the decline.

Processors and end users were also slow in responding to the increase in supply since they still had some expensive inventory they needed to use up or they took their time adjusting final prices. But as usual, the cure to low prices is low prices.

We think the sharp decline in hog futures created opportunities for retailers and processors to book product at advantageous for the spring and pork is expected to be heavily featured going into Memorial Day.

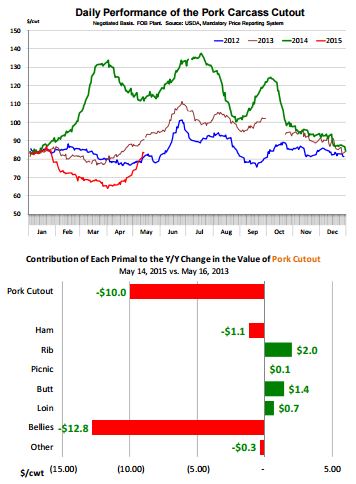

If we look at the performance of the various primals, we can see that for the most part retail items are now performing quite well. The chart shows how each component of the pork cutout compares to the same period in 2013.

Ribs, loins and butts are up significantly compared to 2013, an indication of strong retail demand. Pork butts are up 15 per cent compared to same time in May 2013 while ribs are up 30 per cent.

The ham primal is down 7 per cent but in line with what one would expect given the increase in pork supplies.

The only item that continues to struggle is the belly primal. The belly primal value last night was quoted at $79.22/cwt, $81/cwt (-50 per cent) lower than what it was at the same time in 2013.

Bellies are about 16 per cent of the carcass but the decline in value is so large that it has offset any of the gains from the other primals and then some.

What kind of pork cutout should we expect if bellies return to a more normal trading range (be this due to promotions, seasonal improvement) while other primals continue to follow the seasonal pattern they have so far?

If belly market improves, say in the $120 range by July, then a $100 cutout appears quite possible. In turn this would imply hog prices above what current futures are pricing. But that remains a big if.

Market participants remain nervous about pricing for loins and trimmings past Memorial Day. For now, cash markets are dictating direction.

The panic of winter has been replaced by the euphoria of spring. In a couple of months we will likely be talking about the effect of +2.4 mill head slaughter weeks this fall but for now let’s all enjoy spring blossoms, clean out the grill and savour the brats and ribs bought on sale at the local grocery store.