CME: Mixed Results for US Meat Exports

US - Weekly export numbers for the US have been released and the results were somewhat mixed, with some figures up and some down, write Steve Meyer and Len Steiner.Beef exports to key markets have slowed down in the last couple of weeks, with exports to Asia slowing down after a relatively strong performance in February and March.

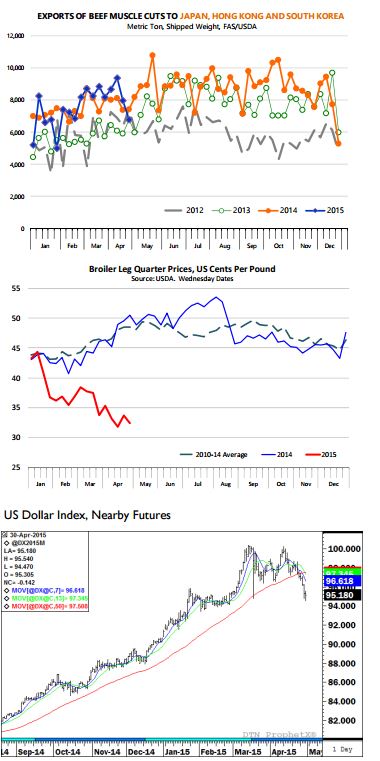

Exports to Hong Kong in the last four reported weeks (Apr 2 - Apr 23) are down about 32 per cent from the same four week period a year ago. On the other hand, exports to Japan and South Korea during the reference period were up 16 per cent and 34 per cent, respectively.

For the last reported week, however, exports to all three key Asian markets were lower than last year.

More problematic for US beef exports have been exports to Mexico, one of the main destinations for US beef. In the last four reported weeks exports to Mexico are down 34 per cent from a year ago and the numbers reported today were down 26 per cent from a year ago.

High prices in the US market and a strong US dollar continue to negatively impact the volume of US beef going to export markets. However, we still think that demand for US beef in Asia remains quite strong.

The decline in exports to Hong Kong reflects some (potentially) short term factors which may be remedied in the coming months. China has emerged as a top world beef buyer and they have once again started to aggressively purchase from South America and Oceania.

As for weekly pork exports, we continue to wait and see if the monthly numbers that will be published next week will help us validate the trends established by the weekly pork export numbers.

Based on the weekly pork exports, we continue to project pork exports for April to be up 2 per cent from a year ago but there is a fairly large confidence range in that projection.

March exports currently are projected to be down 5 per cent from last year. It is worth noting that the weekly data shows a notable improvement in exports to Asian markets compared to earlier in the year.

Particularly worth noting is the increase in exports to China, with the last four weeks averaging almost 2000 MT/week compared to an average of 48MT/week in January and February. Exports to Hong Kong in the last four weeks averaged 672MT and last week alone pork shipments were 1,104MT.

During Jan-Feb, exports to Hong Kong averaged 461 MT/week. Shipments to Mexico and Canada also appear to be quite robust at this time. The improvement in pork export trends certainly is a positive for US pork prices going into the spring and summer.

Last night, the IA/MN lean hog carcass price jumped $2.66 from the previous day and closed at $71.33/cwt, lending further support the April rally in hog futures.

There is no current data for US broiler exports but the recent trend in the price of US leg quarters tells as that broiler exports are struggling.

We will provide a review of the HPAI situation in our report tomorrow but a combination of a strong US dollar, increasing supplies in other markets and HPAI induced bans appear to be taking their toll on chicken dark meat prices.

USDA quoted the price of leg quarters at 32.45 cents per pound, 38 per cent lower than a year ago and 33 per cent lower than the five year average.

The inventory of leg quarters in cold storage at the end of March was 188.7 million pounds, 77 per cent higher than a year ago and 94 per cent higher than the five year average.