CME: MCOOL Retaliation to Impact Canadian, Mexican Producers

US - Three different interesting reports with a bearing on markets will be released by the US Department of Agriculture (USDA) this week, and we have also received the results of the mandatory country-of-origin labelling (MCOOL) dispute, write Steve Meyer and Len Steiner.USDA will release three important reports this Friday: Cattle on Feed, Cold Storage and Chickens and Eggs.

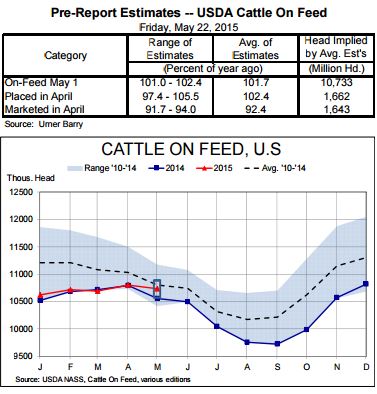

The result of Urner-Barry’s survey of analysts regarding the three key numbers in the monthly Cattle on Feed report appear at right.

Should the average estimate for feedlot placements be realised, this will mark the first time since January and February of 2014 in which placements have exceeded year?ago levels two consecutive months.

Last month’s total of 1.809 million head was 0.4 per cent larger than one year ago.

The Chicken and Eggs report may be one of the most watched in recent times given the devastation that avian influenza has caused in the egg industry in the upper Midwest.

We continue to believe the loss of egg production capacity will have very little impact on the meat sectors.

The latest judgement of the World Trade Organization regarding the United States’ mandatory country?of?origin labelling (MCOOL) program was the same as all the others: Illegal.

That’s the word released yesterday and it now sets the stage for Canada and Mexico to move ahead with retaliatory tariffs.

Canada has published a lengthy list of items that it will consider for those tariffs. That list goes far beyond the meat items at issue in this ruling but includes pork and beef.

Mexico has not published a list of items for potential retaliation but most assume it, too, will include pork and beef as well as a number of other items. This issue has gone far beyond meat and is now a full?blown trade issue between the US and its neighbours.

Mexico was the largest single customer for US pork and second largest customer for US beef in 2014. Canada ranked third for pork exports and fourth for beef exports last year.

Congress required the labels as part of both the 2002 and 2008 Farm Bills. The original labelling rules were held a violation of WTO rules in 2012.

In a move that most observers felt actually made the rules more burdensome, USDA then re-wrote the rules in 2013 to require that products carry labels that specify where animals were born, raised and slaughtered.

After being shot down after two tries at writing rules that satisfy both the law and the WTO, Secretary of Agriculture Tom Vilsack has stated that the law must be changed.

Similar sentiments have been echoed by some of MCOOL’s staunchest supporters in Congress.

We have thought for some time that Congress would allow the WTO process to play out, if for no other reason to be able to claim to MCOOL’s supporters that they were forced to change or abandon the scheme.

But we have always though Congress would act in time to avoid retaliatory tariffs. There is no guarantee that will happen and some sources in Washington fear that the Senate in particular may not take up the issue before Canada and Mexico are allowed to actually impose the tariffs.

Should the tariffs come to fruition, we think the impacts will be very different for each country.

Canada is a surplus country for both beef and pork. As such, its imposition of tariffs may have little impact on US prices.

Canada will simply fill any void left by higher-priced US product from its own surplus. Doing so will leave some export markets currently served by Canada’s industries open for US product.

There will be some mismatch of cuts/products but we see the impact of Canadian tariffs being pretty minimal.

The irony is that any impact Canadian tariffs have will also fall on Canadian producers since Canadian cattle and hog prices are primarily determined by US cattle and hog prices.

That fact will not likely prevent Canada from imposing tariffs on US pork and beef, though, as they rightfully blame MCOOL on those industries - even though large numbers of US producers and, we think, producers representing the vast majority of US production of both species have steadfastly opposed MCOOL from the beginning.

Mexico is a different story. Mexico has a deficit for both pork (it consumes 54 per cent more than it produces) and beef (by only 1 per cent of production but a deficit nonetheless).

It has no surplus from which to backfill for US product whose price is raised by tariffs. That will drive up the prices of both species’ products for Mexico’s consumers.

Further, there will be no automatic opportunity for the displaced US product to move elsewhere, leaving it on the US market or available to the world market putting downward pressure on US prices.

Mexico took 6 per cent of US pork production and 1.8 per cent of US beef production in 2014 so the impact of Mexican tariffs will likely be larger for the US pork sector.