CME: Livestock Futures Rebounding After Last Week's Falls

US - Livestock futures markets have been changeable in the last few days, write Steve Meyer and Len Steiner.Livestock futures closed mixed on Friday, with summer and fall contracts for live cattle and lean hogs declining on the day.

However, markets rebounded on Monday and were sharply higher across the board. Feeder cattle were up more than 200 points on Monday, further sustaining the rally of the past three weeks.

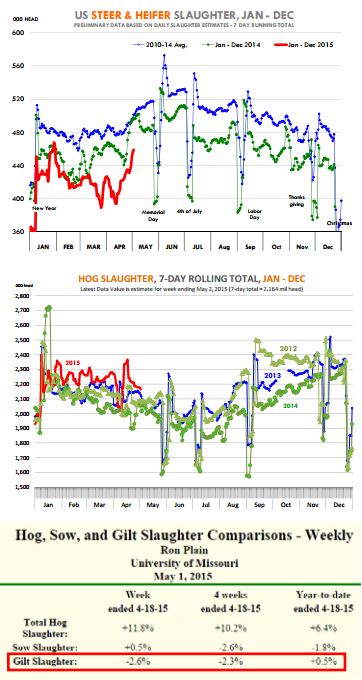

Seasonally slaughter cattle and hog supplies move in opposite direction at this time of year and we are starting to see play out. Cattle slaughter last week was 566,000 head, 4 per cent higher than the previous week but still about 7 per cent lower than a year ago.

Steer/heifer slaughter was 460,000 head, about 26,000 head larger than the previous week but still 7.3 per cent lower than a year ago.

The tug of war between packers and feedlots continues despite the latest USDA feedlot inventory numbers showing feedlot supplies were a bit larger than expected and steady with a year ago.

Feedlots also have placed heavier cattle on feed in the first three months of the year, which is expected to bolster supplies on the front end of the marketing window. Cattle continue to come to market much heavier than last year.

For the week USDA reported the average cattle carcass weight at 815 pounds, 3.6 per cent larger than a year ago. The increase in weights has helped cut in half the impact from the sharply lower slaughter numbers.

Cattle are coming to market at all time record highs for this time of year. Price for fat trimmings, which account for as much 10 per cent of the meat derived from a steer carcass, were sharply lower on Friday. This is an item worth watching as we go into the start of the grilling season.

Supplies of lean domestic grinding beef remain limited and the price of lean cuts that could go into the grinder are at historical highs. We are bringing more lean beef from imports but that lean beef normally does not go into the fresh retail case.

Ground beef will likely be very expensive for Memorial Day, this tends to impact overall volume sold and is negative for fat trim prices.

The choice beef cutout rebounded on Monday, largely because of the recovery in the value of 50CL trimmings (down 17 per cent Friday). Lean hog futures have been on a steady upward trend since late March and futures were higher again on Monday.

There is some uncertainty in the hog complex as market participants consider the outlook for pork sales once the rush of Memorial Day orders slows down.

Cash hog prices have been extremely strong the last few days, with the average weekly IA/ MN lean hog carcass price up $7/cwt compared to the previous week and it was up almost $1 last night as well.

Hog slaughter for the week was 2.164 million head, 1 per cent lower than the previous week but still 7.4 per cent higher than a year ago.

Hog supplies are plentiful but packers were quite aggressive chasing the cash hog market higher and cash hog prices are now very close to cutout values. For now packers need to fill orders for Memorial Day and thus have to pay up for hogs.

Gains in the cutout have come mostly from loins, pork butts, picnics/trim, which generally benefit from better retail demand.

Ham values were steady to lower for the week while belly values are looking to establish an upward trend for the spring.

Despite lower prices from a year ago, hog producers do not seem to be in a panic, with sow and gilt slaughter numbers lower than a year ago (see U of Missouri).