CME: Latest USDA Reports Give Bearish Pork Outlook

US - The US Department of Agriculture's recent Cattle on Feed report creates a bullish outlook for cattle futures, whilst their Cold Storage report indicates a bearish outlook for pork and chicken, write Steve Meyer and Len Steiner.We expect USDA’s monthly Cattle On Feed report, released Friday, to be bullish for Live Cattle futures and especially so for Q4-2015 and Q1-2016 contracts.

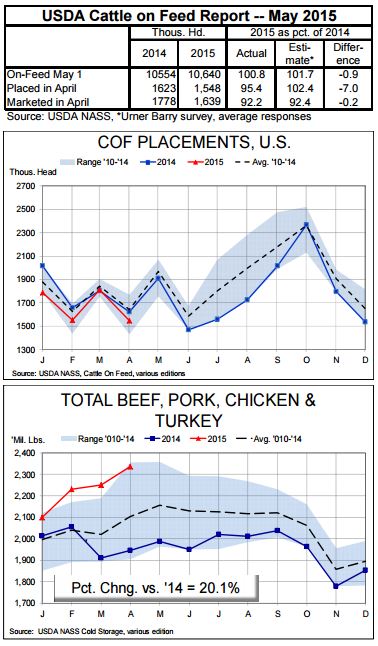

The key numbers from the report appear in the table. The most important is clearly April placements which, at 1.548 million head, came in significantly lower than had been expected, on average, by the analysts surveyed by Urner Barry last week.

The actual number was actually outside the range of the pre-report responses and is 4.6 per cent lower than one year ago.

There are two bullish aspects to this number. First, it implies a smaller level of slaughter in the fourth quarter of this year than even we had expected, and we thought the number would be smaller than the average pre-report estimate.

Cattle numbers will be tight going into the holidays and, though weights may make up some of that decline, they will not likely make up all of it.

The second bullish aspect of these numbers is what they imply about cow herd expansion. The lower placements confirm heifer retention - a fact that should not surprise anyone given the gains we have seen in pasture conditions this spring.

Did anyone notice that there was flooding in Wichita Falls, Texas last week - right in the heart of an area of Texas and Oklahoma that had been plagued by drought for most of the past 5 years?

And it’s not just the Americans that are building the cow herd. Imports of feeder cattle from Canada and Mexico were down 17,000 head in April.

The shorter placements limited year-on-year growth of feedlot inventories to just 0.8 per cent, nearly a full percentage point lower than was expected.

USDA's monthly Cold Storage report indicates that frozen meat and poultry supplies remain ample as of April 30.

While not beyond the high level of the past 5 years as they were in February and March, the April 30 inventory of 2.336 billion pounds was 20.1 per cent larger than one year ago and just 20 million pounds short of the high of the past 5 years for April.

The situation is most bearish for pork and chicken.

Frozen pork inventories on April 30 amounted to 699.6 million pounds, 19.8 per cent higher than last year and 17.5 per cent higher than the average of 2010-2014.

The biggest driver of pork stocks was hams. Total ham inventory of 135.6 million pounds was 66 per cent higher than last year and 43 per cent higher than the 5-year average.

Ham inventories normally increase during summer months as users prepare for holiday demand but these levels in April will dampen the summer increase and may force more hams onto the market, limiting both ham and hog price gains as hog numbers tighten seasonally.

Pork belly inventories of 70.4 million pounds were down nearly 16 per cent from last year’s very high levels but were still nearly 11 per cent higher than the 5-year average.

Year-on-year lower belly stocks and belly prices that continue to run well below year-ago levels suggest that belly demand has softened considerably.

Chicken inventories are burdensome with stocks of 765.5 million pounds exceeding year-ago level by 31 per cent and the 5-year average level by 21 per cent.

The leading culprit is, not surprisingly, leg quarters whose stocks are up nearly 80 per cent form one year ago primarily due to exports slowed by the various reactions of export customers to avian influenza.

But leg quarters are not alone - breast meat stocks were more that 38 per cent larger than one year ago on April 30 as well.

Beef stocks were higher than last year (31 per cent) but we do not view them as burdensome, primarily because we expect beef imports to decline. Such a decline is a normal seasonal pattern for Uruguay and New Zealand. Recent rains in Australia will slow cow slaughter there and reduce grinding beef shipments.